The "Wall Street" Sentiment Analyzer System Design

Resolving Multi-Agent Conflict in Real-Time Financial Trading Systems

Author: AgileWoW Team

Category: Financial Intelligence / Event-Driven Architecture

Read Time: 12 Minutes

Parent Guide: The Agentic AI Engineering Handbook

In financial markets, data is abundant but consensus is rare. A technical indicator might scream "Buy" while a CEO's resignation tweet screams "Sell."

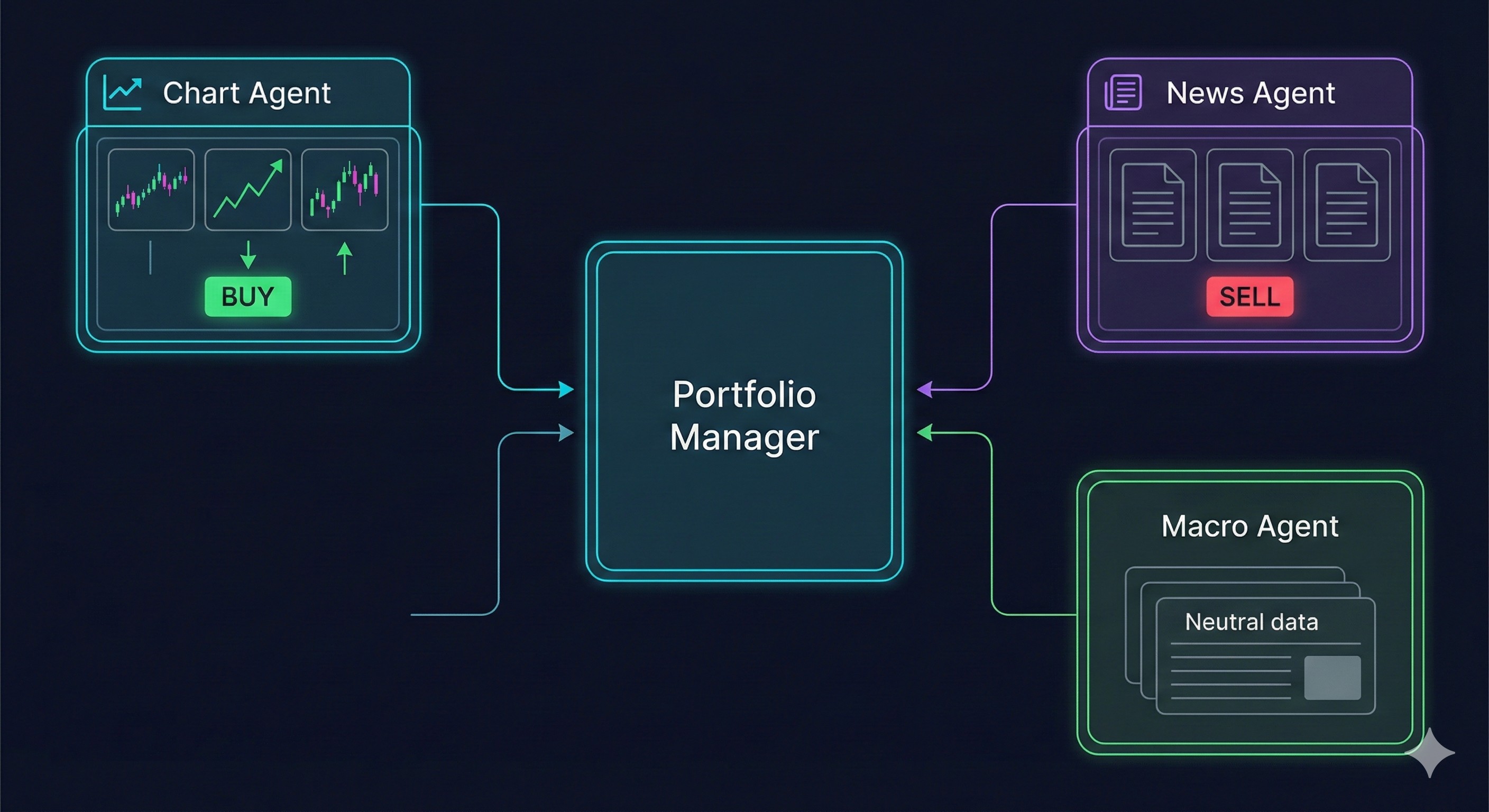

The "Wall Street" Sentiment Analyzer is a Tier 2 system designed to ingest contradictory signals and produce a weighted, rational decision. Unlike a simple chatbot that summarizes news, this system uses a Hierarchical Swarm where specialized agents (Quantitative, Fundamental, Sentiment) debate their findings before a "Portfolio Manager" agent makes the final call.

This blueprint details the Event-Driven Architecture required to handle real-time streams from AlphaVantage and the Consensus Protocols needed to resolve agent disagreement without hallucinating profit.

1. The Design Challenge: The "Buy vs. Sell" Deadlock

Most multi-agent tutorials show agents agreeing with each other. In finance, value is found in disagreement.

The Failure Mode:

- Chart Agent: "RSI is 30. Oversold. Recommendation: Strong Buy."

- News Agent: "SEC just opened an investigation. Recommendation: Strong Sell."

Result: Without a conflict resolution layer, the system either crashes, hallucinates a "Hold," or flips a coin.

The Architectural Goal: Implement "Weighted Consensus." We need a hierarchical structure where a "Manager Agent" weighs the confidence score and time horizon of each sub-agent to render a final verdict.

2. The Tech Stack Selection

To build a system that reacts to the market in real-time, we need a stack that handles streaming data and hierarchical delegation.

| Component | Choice | Why? |

|---|---|---|

| Orchestrator | CrewAI (Hierarchical Process) | Uniquely optimized for "Manager" workflows where one agent delegates tasks and reviews outputs from subordinates. |

| Market Data | AlphaVantage APIs | Provides a dedicated MCP Server for AI agents, allowing direct fetching of RSI, MACD, and News Sentiment without writing custom scrapers. |

| Decision Engine | GPT-4o (The Manager) | The Manager node requires high reasoning capabilities to synthesize conflicting data; smaller models (Llama 3 8B) often fail at this nuance. |

| Event Bus | Redis / Kafka | Essential for decoupling the data stream (price updates) from the agent's reasoning loop. |

3. Architecture Deep Dive: The "Swarm" Topology

3.1 The Agent Roster

We deploy a "Wolf Pack" of four distinct agents, each with a narrow instruction set to prevent overlap.

- The "Technical" Analyst (Quant):

- Tools: AlphaVantage TIME_SERIES_INTRADAY, RSI, MACD.

- Role: Looks only at charts. Ignores news.

- The "Fundamental" Analyst (Warren):

- Tools: OVERVIEW (P/E Ratio, EPS), INCOME_STATEMENT.

- Role: Looks only at balance sheets. Ignores price action.

- The "Sentiment" Analyst (Hype):

- Tools: NEWS_SENTIMENT, Twitter/X API Scraper.

- Role: Scans for fear, uncertainty, and doubt (FUD).

- The Portfolio Manager (Boss):

- Tools: None.

- Role: Reads the three reports. Resolves conflicts. Issues the trade.

3.2 The Conflict Resolution Protocol

How does the Manager decide when the Quant says "Buy" and the Fundamental says "Sell"?

The "Confidence-Weighted" Algorithm:

The Manager is prompted to assign a weight to each agent based on current market conditions (Volatility Regime).

- Low Volatility: Weight Fundamental Analysis (40%) > Technical (30%) > Sentiment (30%).

- High Volatility (News Spike): Weight Sentiment (60%) > Technical (20%) > Fundamental (20%).

Why this matters: A cheap stock (Fundamental Buy) can drop 20% in a day if bad news hits (Sentiment Sell). The Manager must dynamically shift trust to the Sentiment agent during crises.

4. Implementation Guide (CrewAI)

Phase 1: Defining the Manager

In CrewAI, you enable hierarchy by defining a manager_llm and setting process=Process.hierarchical.

from crewai import Crew, Process, Agent

# The Boss

manager = Agent(

role="Portfolio Manager",

goal="Maximize alpha while minimizing drawdown. Resolve conflicting signals.",

backstory="You are a veteran hedge fund manager. You act on evidence, not hype.",

allow_delegation=True,

llm=gpt4_o

)

# The Crew

finance_crew = Crew(

agents=[quant_agent, fundamental_agent, sentiment_agent],

tasks=[analyze_task],

process=Process.hierarchical, # CRITICAL: Enables the Manager Logic

manager_agent=manager

)Phase 2: Connecting the Data (MCP)

Instead of writing Python requests, we configure the AlphaVantage MCP server.

- Config: Add

mcp.alphavantage.coto your agent's tool config. - Usage: The agents can now naturally ask: "Get me the RSI for NVDA on a 15-min interval."

Phase 3: The "Circuit Breaker" Logic

Real-time agents can go rogue during a flash crash. Implement a "Human-in-the-Loop" stop. If Confidence Score < 70%, the Manager output is not "Execute Trade," but "Request Human Review."

5. Use Cases for Financial Swarms

1. Earnings Call Sentinel:

Trigger: A company releases its Q3 earnings PDF.

Action: The swarm instantly parses the PDF (Fundamental), checks the after-hours price drop (Technical), and scans Twitter for reaction (Sentiment) to decide if the drop is an overreaction.

2. Crypto "Whale" Watcher:

Trigger: A massive wallet transfer is detected on-chain.

Action: The Manager weighs "On-chain data" vs "Current Market Depth" to predict if a dump is imminent.

3. Macro-Economic Pivot Prediction:

Trigger: Fed Chairman Powell gives a speech.

Action: Sentiment agent analyzes tone (Hawkish/Dovish) while Quant agent watches bond yield spikes.

6. Frequently Asked Questions (FAQ)

A: While LangGraph offers better control over loops, CrewAI is superior for role-playing and hierarchical delegation. Financial analysis is inherently a "committee" process. CrewAI's abstraction of a "Manager" who reviews "Worker" outputs fits this mental model perfectly with less boilerplate code.

A: They offer a generous free tier (25 requests/day), which is enough for development. For a real-time production agent polling every minute, you will need a premium key to avoid rate limits.

A: Never let an AI execute trades without a sandbox phase. Run your swarm in "Paper Trading" mode for 3 months. Measure its "Sharpe Ratio" (Risk-adjusted return). Only connect it to a real broker API (like Alpaca or Interactive Brokers) once the architecture proves stable.

A: Financial reports are huge. Don't feed the whole 10K report to the agent. Use RAG (Retrieval Augmented Generation) to extract only the "Risk Factors" and "Management Discussion" sections before passing them to the Fundamental Agent.

7. Sources & References

Frameworks

- CrewAI: Hierarchical Process Documentation – How to build manager-led swarms.

- AlphaVantage: MCP Server for AI – The official data connector for LLMs.

Architecture Patterns

- Event-Driven Architecture: Databricks Reference – Patterns for ingesting real-time market data.

- Multi-Agent Conflict Resolution: Galileo AI Strategy Guide – Strategies for fixing coordination disasters.

Industry Analysis

- NVIDIA Blog: Specialized AI Agents in Finance – Case studies on how PayPal and others use agentic workflows.