Build Your Own Bloomberg: A Developer’s Guide to FinTech Sentiment Bots

Quick Answer: The 4-Hour Fintech Stack

- The Goal: Build a real-time sentiment analysis bot that scans financial news and scores it (Bullish/Bearish) automatically.

- The Cost: $0 (Using Free Tier APIs and Open Source Models).

- The Stack: Python + NewsAPI (Data) + Hugging Face FinBERT (Brain) + AWS Lambda (Automation).

- The Alpha: Institutional terminals cost $24,000/year. This bot mimics their "News Sentiment" feature for free.

Introduction: The $24,000 Moat is Gone

Wall Street has a secret: they don't read the news. They have algorithms read it for them.

For decades, the Bloomberg Terminal gave institutional investors an unfair advantage, instant access to sentiment data that retail traders couldn't see.

Today, that moat is gone.

With Python and open-source Large Language Models (LLMs), you can build a system that rivals the big banks. This guide shows you exactly how to architect it.

Important: This technical guide is a core module of our comprehensive The AI Alpha Report: Analyzing Today's Top Market Movers with Machine Learning. If you want to understand the strategy behind the code, start there.

Phase 1: The Architecture (How It Works)

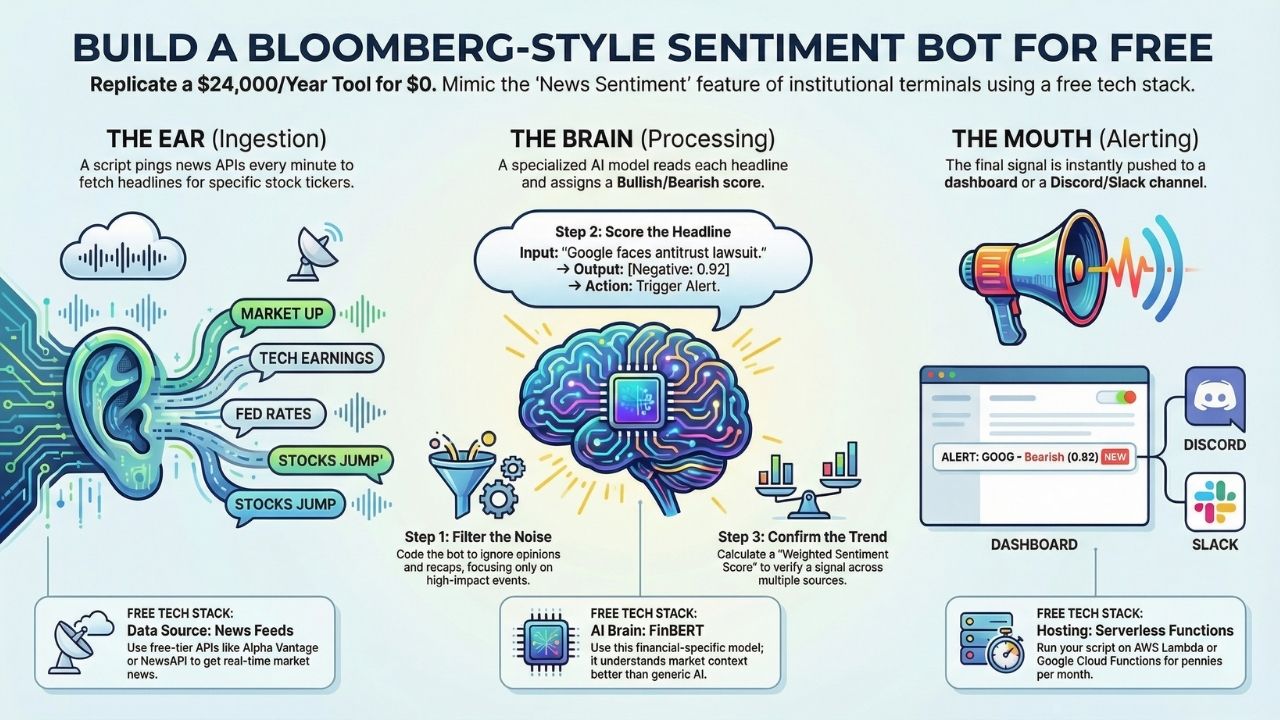

To build a "Bloomberg Lite," you need to replicate three specific functions of a high-speed fintech terminal.

We are not building a simple web scraper. We are building an ETL (Extract, Transform, Load) Pipeline optimized for finance.

The Workflow:

- The Ear (Ingestion): A script that pings news APIs every 60 seconds to fetch headlines for specific tickers (e.g., $AAPL, $GOOGL).

- The Brain (Processing): An NLP model that reads the headline and assigns a score (-1.0 to +1.0).

- The Mouth (Alerting): A webhook that pushes the "Alpha" signal to your dashboard or Discord server.

Dev Note: Speed matters. Institutional algorithms react to news in milliseconds. Your Python bot needs to be lightweight and asynchronous.

Phase 2: The Tech Stack (The "Free Tier" Build)

You do not need an enterprise budget. You need the right libraries.

Here is the exact stack we use for our internal sentiment analysis tools:

1. Data Source (The Feeds)

- Alpha Vantage: Excellent free tier for market news and sentiment data.

- NewsAPI: Good for general global news, but requires filtering for financial context.

- Yahoo Finance (yfinance): The classic choice for historical data, though often rate-limited.

2. The "Brain" (NLP Models)

- Do NOT use generic ChatGPT: It is too slow and expensive for high-frequency scanning.

- Use FinBERT: This is a version of BERT (Google's NLP model) specifically pre-trained on financial text. It understands that "volatility" is bad, whereas generic models might think it's neutral.

3. The Library

- Hugging Face Transformers: To load FinBERT locally.

- Pandas: For structuring the time-series data.

Phase 3: The Logic (Coding the "Alpha")

This section outlines the logic flow you need to implement in Python.

Step 1: The Filtering Layer

Raw news is noisy. A "Bloomberg" bot doesn't just read everything; it filters for Impact Events.

Your code must discard "Top 10 Stocks to Buy" (Opinion/Spam) or "Market Recap" (Old News).

It must prioritize:

- "Earnings Miss"

- "Regulatory Fine"

- "CEO Resignation"

We used this exact filtering logic when we built our Jerome Powell "Lie Detector", where we trained a bot to ignore filler words and focus purely on "Hawkish" vs. "Dovish" signals.

Step 2: The Scoring Loop

Once you have a clean headline, you pass it to the model.

- Input: "Google faces antitrust lawsuit over ad tech."

- FinBERT Output: [Negative: 0.92, Neutral: 0.05, Positive: 0.03]

- Action: If Negative > 0.80, trigger SELL alert.

Step 3: Calculating "Weighted Sentiment"

One article doesn't move the market. You need Volume x Sentiment.

If 50 credible sources post negative headlines about Visa ($V) within 15 minutes, that is a trend.

Your bot should calculate a "Rolling Sentiment Score" (e.g., 1-hour moving average) to confirm the signal before alerting you.

Phase 4: Legal & Hosting (Don't Get Banned)

Building the bot is the easy part. Keeping it alive is harder.

The "Rate Limit" Trap: If you scrape Google News every 5 seconds, your IP will be banned.

Solution: Use rotating proxies or stick to official APIs like Alpha Vantage that have clear rate limits (e.g., 5 calls/minute for free users).

The Hosting Solution

Do not run this on your laptop. AWS Lambda / Google Cloud Functions are perfect for this.

You can set a "Cron Job" to wake up your script every 5 minutes, check the news, and go back to sleep. This costs pennies per month.

Legal Warning

Scraping public data is generally legal, but Terms of Service are binding. Always check the robots.txt file of any site you scrape.

For financial data, paying for a low-cost API (like $20/mo) is often cheaper than fighting a legal battle or dealing with broken scrapers.

Conclusion: Code is the New Cash

The era of "gut feeling" investing is over.

By building this bot, you are not just saving $24,000 a year. You are learning the fundamental skill of modern finance: Information Arbitrage.

The market rewards those who process information the fastest. You now have the blueprint to build the machine that does exactly that.

Frequently Asked Questions (FAQ)

Yes, but it comes with trade-offs. ChatGPT is smarter and handles nuance better, but it is significantly slower and costs money per API call.

For a high-frequency bot checking thousands of headlines, a local model like FinBERT (running on Hugging Face) is faster and free.

Alpha Vantage is widely considered the best for developers starting out. It provides structured sentiment data, meaning they have already done the NLP work for you.

MarketAux is another strong contender that focuses specifically on financial news sentiment.

It depends. Scraping "publicly available" data is often protected, but you must respect the site's robots.txt file.

Aggressive scraping that slows down a website can lead to legal action under the CFAA (Computer Fraud and Abuse Act). Always prefer official APIs over raw HTML scraping to stay safe.

Sources & References

Disclaimer: This article is for informational and educational purposes only. It is not financial advice. All stock analysis is generated by experimental AI models and should not be the sole basis for investment decisions.