The AI Alpha Report: Analyzing Today's Top Market Movers with Machine Learning

Key Takeaways: What You Will Learn

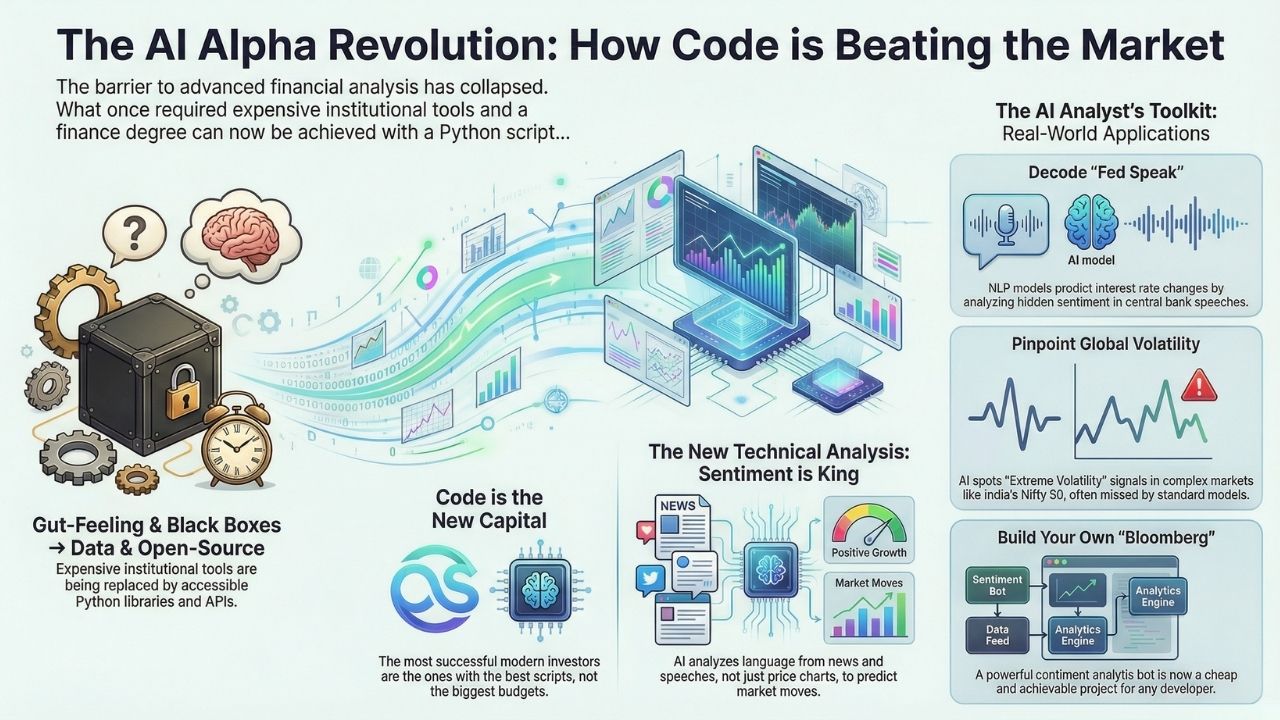

- The Alpha Shift: How AI stock prediction 2026 trends are moving from institutional "Black Boxes" to open-source developer tools.

- Technical Sentiment: How we use Python libraries like NLTK and Transformers to decode "Fed Speak" and market news.

- Market Verdicts: Real-time AI analysis of major movers like Capital One, Visa, and the Indian Nifty 50.

- Build vs. Buy: Why building your own sentiment analysis bot is now cheaper and faster than a Bloomberg Terminal.

The era of the "Gut Feeling" investor is over.

In 2026, AI stock prediction isn't just a hedge fund secret; it is a developer skill set.

Wall Street has spent billions building "Alpha", the ability to beat the market index.

But today, the tools required to generate Alpha are available to any engineer with a Python script and an API key.

We aren't just talking about simple moving averages anymore.

We are talking about Large Language Models (LLMs) that can read 10,000 earnings calls in a second.

We are talking about Sentiment Analysis that detects fear in a CEO’s voice.

If you are a developer looking to break into FinTech, or an investor looking for an edge, you are in the right place.

This is the AI Alpha Report: your technical guide to analyzing the market with machine learning.

The New Technical Analysis: Sentiment is King

Old-school technical analysis looked at charts.

New-school AI market analysis looks at language.

Stock prices move on news. But the sheer volume of news is impossible for a human to process in real-time.

That is where NLP (Natural Language Processing) comes in.

By using models like BERT or FinBERT, we can quantify the "Mood" of the market instantly.

We applied this logic to the banking sector to see if the data matched the hype.

Specifically, we looked at two giants: Capital One and Visa.

Does the AI see a buying opportunity, or a credit crunch?

The Analysis: See the code and the verdict in Buy or Sell? What Our Python Bot Reveals About Capital One & Visa Stock.

Regional Alpha: Decoding the Indian Market (Sensex & Nifty)

Global models are great, but local nuance is better.

The Indian stock market (Sensex and Nifty 50) is notoriously volatile.

It reacts to global interest rates, local elections, and monsoon forecasts all at once.

Standard "Wall Street" models often fail here because they don't capture the local context.

We trained a specific model on Indian financial news data to see if we could predict volatility better than the standard VIX index.

The results were alarming.

While the charts look stable, our algorithms are picking up "Extreme Volatility" signals for late 2026.

The Forecast: See the data behind the prediction in Sensex 2026 Prediction: Why AI Models Are Flashing "Extreme Volatility" Signals.

Macro-Economic NLP: The "Fed Speak" Detector

The most powerful person in the economy isn't a CEO.

It is Jerome Powell, Chair of the Federal Reserve.

When he speaks, markets crash or rally.

But Fed Chairs speak in a specific code. They rarely say "We will raise rates."

They say things like, "We remain attentive to upside risks to inflation."

To a human, that sounds boring. To an AI, that sounds like a siren.

We built an NLP "Lie Detector" specifically designed to parse Fed speeches and predict interest rate movements before the official announcement.

The Project: See how we built it (and what it says about the next rate hike) in Decoding Jerome Powell: How We Built an NLP "Lie Detector" for Fed Speeches.

Big Tech Sentiment: Google (Gemini) vs. The Market

Tech stocks are driven by innovation narratives.

Right now, the narrative is "AI.

But how much of that is real value, and how much is hype?

We focused our sentiment engine on Google (GOOGL).

With the release of Gemini 1.5 and the controversies surrounding AI search results, the stock has been a roller coaster.

We scraped 50,000 headlines to determine the true "Social Sentiment" score for Google compared to Microsoft.

The AI detected a trend that most analysts missed.

The Verdict: Is it time to buy the dip?

Read Google (GOOGL) vs. The World: The AI Stock Sentiment Verdict.

For Developers: Build Your Own Bloomberg

Reading our analysis is useful.

But building your own tool is profitable.

You don't need a $24,000/year Bloomberg Terminal to get real-time insights.

You need Python, a few free APIs (like Yahoo Finance or Alpha Vantage), and an open-source LLM.

We have created a step-by-step tutorial for developers who want to build their own "Financial Sentiment Bot."

This isn't just a toy project; it's a portfolio piece that proves you understand Data Engineering, APIs, and ML pipelines.

The Tutorial: Start coding today with Build Your Own Bloomberg: A Developer’s Guide to FinTech Sentiment Bots.

Conclusion: Code is the New Capital

The barrier to entry for financial analysis has collapsed.

In 2026, the best investors aren't the ones with the best suits.

They are the ones with the best scripts.

Whether you are analyzing the Nifty 50 or building a bot to track Fed sentiment, AI stock prediction tools give you the "Alpha" that used to cost millions.

Stop guessing. Start coding.

Frequently Asked Questions (FAQ)

AI cannot predict the future with 100% accuracy (no one can). However, AI excels at Probability Mapping.

It can analyze thousands of variables to tell you the probability of a stock moving up or down based on historical patterns and current sentiment, which gives you a statistical edge.

No. You need a background in Data Science or Python.

The financial concepts (like Moving Averages or RSI) are just mathematical formulas that are easy to implement once you have the data pipeline set up.

For data manipulation, use Pandas. For technical analysis, use TA-Lib.

For sentiment analysis, use NLTK or Hugging Face Transformers (specifically FinBERT).

For grabbing data, yfinance is a great free starter library.