From Automation to Oversight: The Rise of AI Tax Agents for CA in 2026

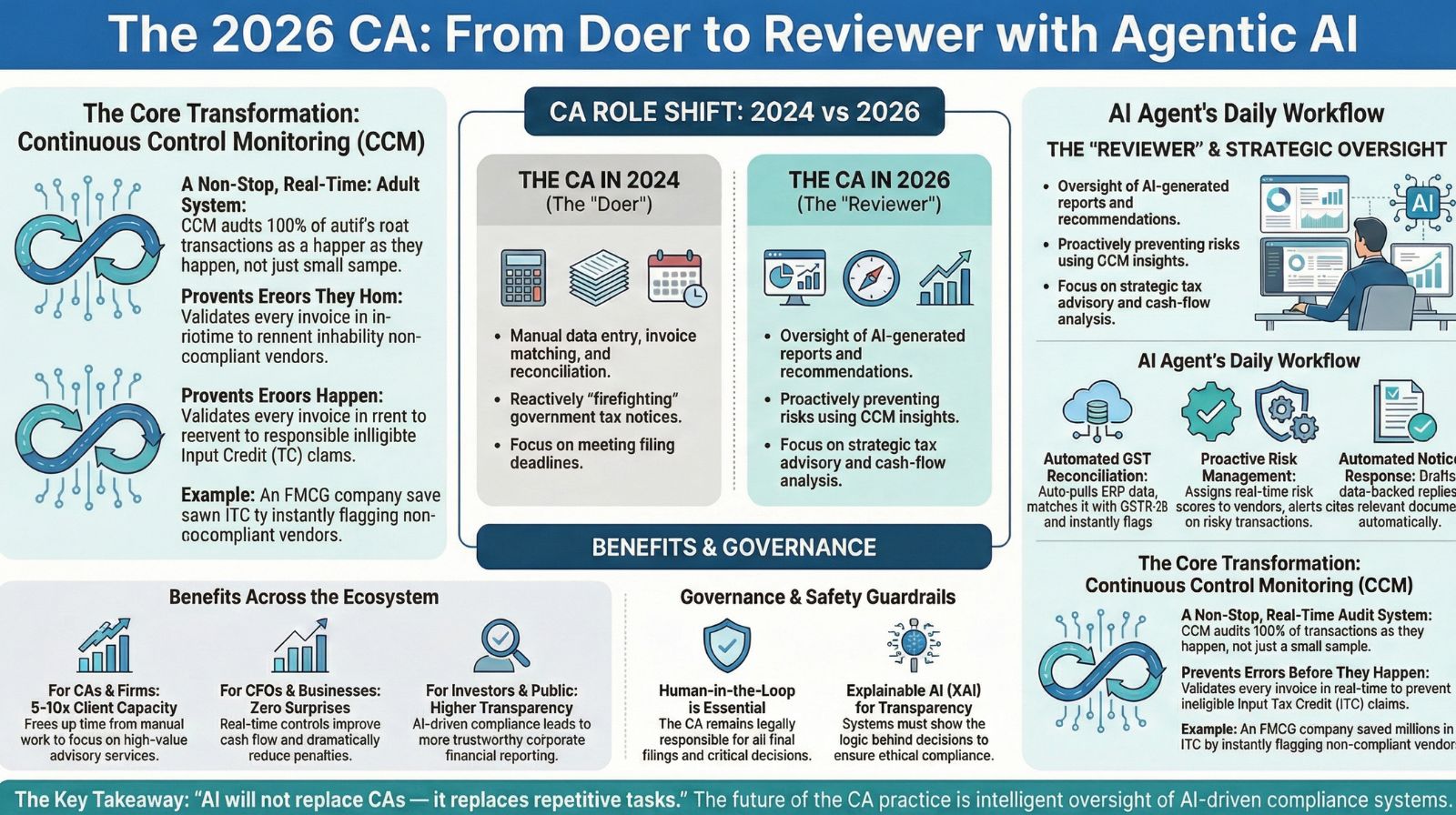

The Indian financial landscape is undergoing a fundamental transformation, heralding The Era of Agentic AI & Vernacular Banking. At the heart of this revolution is the way businesses handle compliance, specifically GST filing and auditing. For Chartered Accountants (CAs), CFOs, Fintech startups, and even the general public, 2026 marks a crucial pivot: the shift from being a hands-on 'Doer' to a strategic 'Reviewer' of tax compliance. The future CA will not just use software; they will oversee AI agents that manage complex compliance workflows in real-time, ushering in an era of unprecedented accuracy and strategic focus.

Related Deep Dives on Agentic AI & Finance 2026

The Shift: From Filing Software to AI Tax Agents

You’re already using technology for tax. But traditional software is a tool; the new AI Tax Agents are digital employees. A traditional GST software is reactive; it processes data you feed it. An AI Tax Agent is proactive and autonomous. It constantly monitors your company's data, identifies risks, suggests optimizations, and is always audit-ready.

The Agent's Daily To-Do List:

- GST Reconciliation Automation: The agent automatically pulls data from your ERP, matches it with the GST portal’s GSTR-2B/2A data, and instantly flags mismatches. It can reconcile thousands of entries in minutes.

- Real-Time Filing Preparation: It structures the data for GSTR-1 and GSTR-3B filings continuously, leaving the human CA with a single 'Review and Submit' action.

- Automated Tax Scrutiny Defense Tools: When a notice is triggered by the GST system, the AI agent can automatically draft the initial, data-backed response, citing the exact documents and transactions that support the company's claim.

The Power of Continuous Control Monitoring (CCM)

The biggest change AI brings is the death of the year-end scramble. It introduces Continuous Control Monitoring (CCM). CCM is an AI-driven Continuous Audit Software which can perform non-stop audit. Instead of testing a small sample of transactions once a year, the AI audits 100% of your company data, 24/7. Continuous Audit Software India is not just about filing; it’s about auditing the internal controls and transactions as they happen.

- Real-Time Transaction Validation: Every invoice raised or received is instantly checked against a complex matrix of GST rules, vendor compliance history, and internal policy controls. If a transaction risks an ineligible Input Tax Credit (ITC) claim, the AI flags it before the payment is made or the return is filed.

- 100% Data Coverage: Unlike traditional audits that rely on sampling, CCM leverages the speed of AI to audit the entire population of transactions. This ensures zero risk of material errors slipping through.

- Proactive Risk Scoring: The AI agent assigns a real-time risk score to every vendor and every branch based on their compliance behaviour (timely GSTR-1 filing, mismatch history, etc.). This allows the business to proactively block payments to high-risk vendors until they comply, saving millions in blocked working capital.

Example in Action:

A large FMCG company used to discover an ITC mismatch worth ₹50 Lakhs during the monthly GST Reconciliation Automation. With CCM, the AI Tax Agent flagged the non-compliant vendor instantly, allowing the company to withhold payment of ₹5 Lakhs until the vendor filed correctly, turning a potential loss into a guaranteed recovery.

The following summarizes the key differences between Traditional Audit Software and CCM:

| Feature | Traditional Audit/Periodic Software | Continuous Control Monitoring (CCM) |

|---|---|---|

| Frequency | Periodic (Monthly, Quarterly, Annually) | Continuous / Real-Time |

| Coverage | Sample-based (e.g., 10% of transactions) | Full Population (100% of data) |

| Focus | Finding past errors | Preventing future risks |

| Tool | GST filing software, Excel | Continuous Audit Software India, AI Agents |

By detecting an Input Tax Credit (ITC) mismatch or a vendor compliance risk the moment a transaction is logged, CCM dramatically reduces the chance of penalties and the headache of Automated Tax Scrutiny notices. This moves tax compliance from a necessary chore to a continuous, strategic function.

The Evolution of the CA: From Manual Taskmaster to Strategic Reviewer

The fear that AI will replace CAs is misplaced. AI replaces tasks, not judgment...

The fear that AI will replace CAs is misplaced. AI replaces tasks, not judgment. The current state of tax technology focuses mainly on automation, tools that execute routine, repetitive tasks faster, such as importing data or preparing draft returns. However, the next generation of AI Tax Agents goes far beyond basic automation. These systems demonstrate true agency: they can observe, decide, act, and learn without constant human prompting, making them powerful AI tools for CA practice automation in India. In short, the role of the CA is shifting from a Doer to a Reviewer, elevating the profession to higher-value, strategic work.

| The CA in 2024 (The "Doer") | The CA in 2026 (The "Reviewer") |

|---|---|

| Manual Work: Data entry, invoice matching, GSTR-2B reconciliation. | Oversight: Validating the AI agent’s reconciliation report and final filing recommendations. |

| Compliance: Focusing on meeting deadlines and avoiding immediate penalties. | Strategy: Interpreting AI's risk reports to advise clients on better vendor selection, cash flow management, and tax planning. |

| Firefighting: Reacting to government-issued tax notices and spending time gathering past data for defense. | Preventative Advisor: Using Continuous Control Monitoring to proactively eliminate risks before they become a notice. |

Due to this evolution, CAs in 2026 will use their deep knowledge of Indian tax law and business context to validate the strategies presented by their AI Tax Agents. With reduced time spent on GST data processing, more resources can be dedicated to advising clients on advanced financial planning, supported by AI-enabled CA automation tools in India.

Key Takeaway for All Stakeholders

The adoption of AI agents for GST filing India is not just an operational upgrade; it’s a strategic advantage for the entire financial ecosystem:

- For CA and CA Firms: This technology allows you to serve 5-10 times the number of clients with higher accuracy. Your services become less about transaction processing and more about assured compliance and sophisticated advice. This scalability ensures your practice thrives in the new digital economy.

- For CFOs/Businesses and Fintech Startups: Continuous Audit Software means zero surprises. Compliance becomes an operational excellence program, not a year-end risk. This translates directly into better cash flow and fewer penalties.

- For Retail Investors and the Public: Increased corporate compliance driven by AI creates a more transparent and trustworthy financial market. Companies with robust CCM frameworks are inherently lower-risk, promoting greater confidence in financial reporting and stability in the economy.

The future of tax is not about the automation of manual effort; it's about the intelligent oversight of agentic systems. CAs who embrace this evolution will transition from being compliance providers to becoming indispensable strategic partners in the Indian Finance in 2026 landscape.

Frequently Asked Questions (FAQs)

AI replaces tasks (like data entry, reconciliation, and automated return filing), but it does not replace human judgment, legal interpretation, ethical decision-making, or strategic advisory skills. The CA's role is shifting from a 'Doer' of manual compliance to a 'Reviewer' and strategic advisor who validates the AI-generated strategies and manages client relationships.

CCM is an AI-driven, non-stop audit of your company's data and controls (like invoice processing and vendor checks). Unlike a regular audit, which is periodic and based on sampling, CCM audits 100% of transactions in real-time. This allows the business to prevent errors, optimize Input Tax Credit (ITC), and maintain 'audit-ready' records 24/7, dramatically reducing penalties and the risk of Automated Tax Scrutiny.

The main risks are Data Security (protecting sensitive client data) and Accountability. Tax systems require a 'Human-in-the-Loop' model, meaning the CA remains legally responsible for the final filing, regardless of the AI's recommendation. Systems must prioritize Explainable AI (XAI) to transparently show the logic behind every decision, ensuring ethical compliance and preventing algorithmic bias.

AI agents positively impact cash flow by ensuring 100% accurate GST Reconciliation Automation in real-time, preventing ITC mismatches and maximizing claim eligibility. They also reduce operational costs by automating manual tasks and lower risk costs by proactively defending against Automated Tax Scrutiny notices, leading to fewer penalties and interest payments.

Sources and References

- India AI Governance Guidelines

- India AI Governance Guidelines: Empowering Ethical and Responsible AI

- Closing the AI accountability gap: defining an end-to-end framework for internal algorithmic auditing

- AI and Big Data in Public Accounting: RevolutionizingAuditProcesses and Financial Reporting

- 2026 Buyer's Guide: How to Evaluate GST ITC reconciliation Automation Software in India

- GST Reconciliation and Matching: Importance and Procedure

- Practical Use of AI in CA Practice: Tools, Workflows & Real Office Applications