Deepfake Defense & Biometric Security in Indian Banking

In 2024, the business world was obsessed with one question: "How do I automate this?"

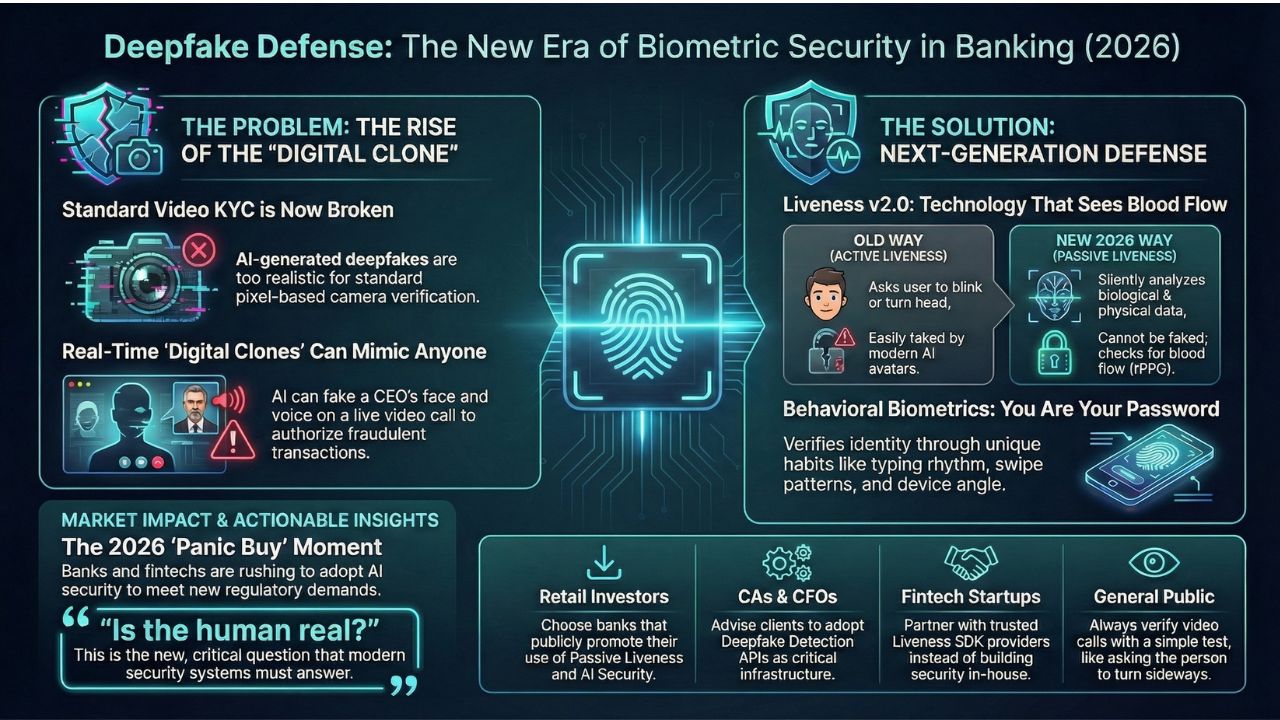

By 2026, the question has shifted to a frantic whisper: "Is this person actually real?"

Welcome to 2026. The era of trusting a face on a screen or a voice on the phone is officially over.

We have entered the age of Agentic AI, where digital assistants can book your flights, manage your portfolio, and unfortunately, steal your identity with terrifying precision.

For Chartered Accountants (CAs), CFOs, Fintech founders, and every UPI user in India, the ground rules of financial safety have shifted beneath our feet.

We are moving from the era of "passwords and OTPs" to the era of the Deepfake Defense. Here is a deep dive into the invisible war being fought in Indian finance and how Biometric Security Banking is evolving to keep your money safe.

Related Deep Dives on Agentic AI & Finance 2026

1. The Threat Landscape: Why Standard Video KYC is Broken

Do you remember the "Video KYC" boom of the early 2020s? It felt revolutionary. You held up your PAN card to your phone camera, an agent verified your face, and your account was open.

In 2026, that system is not just outdated; it is a dangerous vulnerability.

The Rise of the "Digital Clone"

Generative AI has evolved from creating blurry images to generating hyper-realistic, real-time video avatars.

The Scenario: A fraudster sits in a basement in a remote location. They feed a 30-second audio clip of a Company CEO or a family member into an AI model.

The Attack: They call a bank manager or a finance executive via video.

The face on the screen looks like the CEO. The voice sounds exactly like the CEO. The avatar even blinks, breathes, and reacts to questions.

The Failure: Standard cameras only see pixels. They cannot tell if the light hitting the lens is reflecting off a real human face or generated by a graphics card.

This massive gap in security is driving the urgent demand for a robust Deepfake detection API for banks. The old "eye test" is no longer enough.

2. The Solution: Enter "Liveness v2.0" (The Technology That Sees Blood Flow)

To stop a fake face, banks and fintechs are deploying next-generation Liveness Detection SDK technology. But this isn't the annoying "please blink your eyes" technology of the past. This is Liveness v2.0.

Active vs. Passive Liveness: A Critical Difference

1. Active Liveness (The Old Way): The app asks you to "turn your head left" or "smile." Why it fails in 2026: sophisticated AI agents can now follow these instructions in real-time. If the app says "blink," the deepfake avatar blinks.

2. Passive Liveness (The 2026 Way): This works silently in the background without you doing anything. It uses advanced physics and biology:

- rPPG Technology (Micro-Blood Flow): Believe it or not, a real human face changes color slightly every time your heart beats (imperceptible to the human eye, but visible to the camera). A deepfake video on a screen does not have a pulse. The software looks for this "life signal."

- Texture Analysis: Real skin reflects light differently than a computer screen or a 2D mask. The Liveness detection SDK India is adopting analyzes skin texture to ensure it's organic material.

- Depth Sensing: It checks if the face is a 3D object occupying real space, or a flat projection.

Note for Fintech Startups: If your onboarding flow still relies on simple video calls, you are a target. Integrating Passive Liveness is the only way to "Deepfake-proof" your platform.

3. Behavioral Biometrics: You Are Your Password

Passwords can be stolen. OTPs can be phished. Your phone can be unlocked while you sleep. But there is one thing a fraudster cannot copy: Your neurological habits.

Behavioral Biometrics is the silent guard that never sleeps. It verifies users based on how they behave, not just what they know.

The Invisible Checklist

When you open your banking app in 2026, the AI is analyzing hundreds of micro-movements:

- Typing Rhythm (Keystroke Dynamics): Do you type fast with two thumbs? Or slow with one index finger? Do you hesitate before typing your own email address? (A real user doesn't; a fraudster reading from a script does).

- Gyroscope & Angle: Most people hold their phone at a roughly 45-degree angle while using UPI. The Scam Detector: If a transaction is initiated while the phone is lying perfectly flat on a table, it signals a "Remote Access Tool" (RAT) attack, which means a hacker is controlling your phone from a PC. The app detects this anomaly and blocks the money instantly.

- Touch Pressure & Swipe Velocity: Bots swipe in perfect straight lines. Humans swipe in imperfect curves with varying pressure.

Use Case: This is the ultimate weapon in Behavioral biometrics for UPI fraud. Even if a scammer tricks you into giving them access, the system recognizes that the behavior doesn't match the owner, triggering a "step-up authentication" (like a biometric face scan).

4. The Business Shift: The "Panic-Buy" of 2026

For the CFOs, CAs, and investors reading this, the shift to Deepfake Defense represents a massive reallocation of capital. The "AI Audit" is the New Tax Audit.

In 2026, regulators are clamping down. Banks are required to prove that their systems can distinguish between a human and an AI agent.

The CPC Opportunity: Search terms like "Deepfake defense" and "AI Audit" are commanding the highest Cost Per Click (CPC) in the B2B ad market. Why? Because banks are "panic-buying" solutions. A single deepfake scandal can destroy a bank's reputation overnight.

The demand for a reliable Deepfake detection API is outstripping supply.

For Chartered Accountants: When auditing a client's risk factors, you must now ask: Does this company rely solely on OTPs? If so, they are high-risk. You must advise them to look into Biometric Security Banking standards.

5. Summary: What This Means for You

To wrap up, here is how this shift impacts different stakeholders in the Indian ecosystem:

| Audience | Actionable Insight for 2026 |

|---|---|

| Retail Investors | Invest in banks and tech firms that are vocal about "Passive Liveness" and "AI Security." These are the companies that will survive the fraud wave. |

| CAs & CFOs | Treat "Identity Verification" as a critical infrastructure cost, not an IT expense. Recommend Deepfake detection API for banks to your clients immediately. |

| Fintech Startups | Don't build your own security. The AI moves too fast. Partner with established Liveness detection SDK India providers to stay compliant. |

| General Public | The Golden Rule: If a family member or bank official asks for money over a video call, ask them to wave their hand in front of their face or turn sideways. Or better yet, call them back on a regular phone line. |

The Final Verdict

In 2026, security is no longer about building higher walls; it’s about better vision. The question isn't "Is the password correct?", it's "Is the human real?"

Deepfake Defense and Behavioral Biometrics are not just fancy buzzwords; they are the essential bridge allowing us to cross into the future of Agentic AI safely.

Frequently Asked Questions (FAQs)

No, they will not stop working, but they will become "secondary." You will still use your PIN for final approval, but the primary security layer will be Passive Liveness (your phone checking if you are a real person) and Behavioral Biometrics (checking if you are the one holding the phone). If these invisible checks fail, your PIN won't even matter, the app will lock automatically.

Think of Video KYC as a "digital reception desk" where a human agent looks at your ID card via video call. Liveness Detection is a "digital doctor" that uses software to scan your skin texture, blood flow (rPPG), and 3D depth to ensure you aren't a deepfake mask or a pre-recorded video.

Yes. By 2026, "Voice Cloning" technology needs only 3 seconds of your audio (from an Instagram story or a spam call) to generate a full conversation in your voice. This is why banks are moving away from "voice passwords" and towards Behavioral Biometrics (how you type/swipe) which is much harder to fake.

It is generally considered privacy-safe because it does not store your personal data (like what you are typing). It only stores how you type (speed, pressure, rhythm). It creates a mathematical "profile" of your habits without knowing your secrets.

Advise them to audit their payment workflows. If their systems allow high-value transfers based only on SMS OTPs, they are vulnerable to "SIM Swapping" and AI fraud. Recommend they integrate Liveness Detection SDKs and Device Intelligence layers immediately to meet upcoming RBI compliance standards.

Sources and References

- RBI’s 2025 Authentication Mandate: Why Device-Level Intelligence Is Now Critical

- RBI's New Rules For Enhanced Digital Payment Security Move Beyond SMS-based OTPs

- 90% Indians exposed to fake endorsements in 2025: Deepfake Deception List

- Strategies to Combat Deepfake Fraud and Synthetic Identity Threats in Financial Services

- Advancements in Remote Photoplethysmography

- 5 Best Liveness Detection Softwares In India

- Top 5 Cyber Security Predictions for 2026

- Preparing for the next wave of deepfake fraud in 2026