Indian Finance in 2026: The Era of Agentic AI & Vernacular Banking

Imagine a new digital reality where your money manages itself. This isn't a sci-fi future; it's the imminent transformation of AI in Indian Finance. The year 2026 marks the definitive end of the "digital banking" era and the beginning of the Fintech India 2026 landscape, driven by two powerful, interconnected forces: AI Agents that act without human intervention, and a deep push toward financial services in local languages. The question for every bank, fintech, and investor has shifted: In 2024, we asked, "How do I automate this?" In 2026, the question is, "Can the AI do this for me?". This is the AI finance India 2026 outlook.

1. The Evolution: From Chatbot to Autonomous Agent

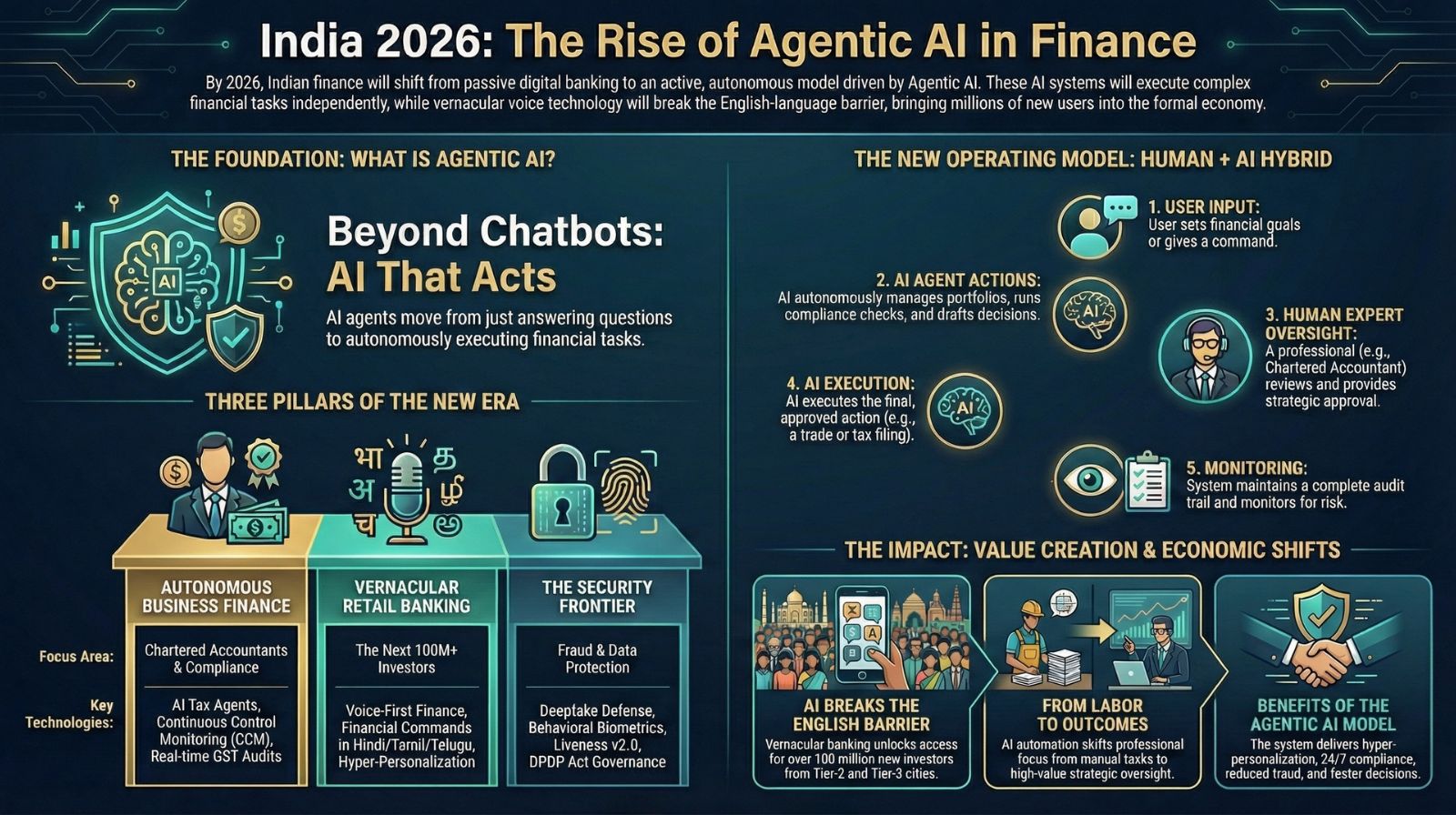

We are leaving behind the age of the simple chatbot that only answers questions. The future is about Agentic AI in Banking. These sophisticated programs are not just recommending actions; they are executing them autonomously.

- AI Agents for Autonomous Transactions India: An AI agent, armed with the context of your income, risk profile, and market signals, will not just suggest you buy a specific mutual fund, it will actively manage and rebalance your portfolio on a minute-by-minute basis, only notifying you of the outcome.

This level of autonomy requires the industry to fundamentally rethink security and accountability.

2. Breaking the Language Barrier: The Power of Vernacular Banking

For decades, the Indian finance world has operated primarily in English, creating a massive barrier for the next 100 million investors in Tier-2 and Tier-3 cities. Vernacular Banking is the movement that finally breaks this divide.

Agentic AI & Vernacular Banking will merge to create an entirely new customer experience. Voice AI technology is rapidly maturing to understand and process complex financial instructions in Hindi, Tamil, Telugu, and other regional languages. This is the true democratization of wealth, allowing a user to confidently manage their entire financial life by simply speaking to an application.

3. The Regulatory Anchor: The DPDP Act

This massive shift in data usage and AI autonomy is occurring under the shadow of a matured legal framework. The Digital Personal Data Protection (DPDP) Act, 2023 impact on AI lending is already being felt. The Data Protection Act forces financial firms to be meticulous about consent and data processing, especially as AI agents use highly personal data, like spending habits, to build hyper-personalized financial products. The balance between innovation and protection will define which fintechs thrive and which ones face crippling penalties.

4. AI-Driven Finance: The Three Pillars Redefining the Modern Workforce

The new era of autonomous finance creates new roles, new opportunities, and new risks across every segment of the industry. Here is a concise summary of the three strategic clusters that make up this workforce transformation:

The Evolution of the CA (B2B)

By 2026, the Chartered Accountant’s (CA) job will shift from being a "doer" to a "reviewer". Instead of spending weeks on manual entry and reconciliation, the CA will oversee an AI agent that files taxes and monitors compliance in real-time, a concept known as Continuous Control Monitoring (CCM). This allows the CA to focus on validating AI-generated tax strategies and offering strategic advisory services.

Deep Dive: Read the full analysis: From Automation to Oversight: AI Tax Agents for CA in 2026.

The New Retail Investor (High Volume/CPC)

The next wave of Indian retail investors will interact with finance using their voices, not a keyboard. This shift to Voice-First Finance & Hyper-Personalized Wealth Management means that an AI will construct a unique portfolio for you not just based on a survey, but on your actual, real-time spending and savings habits. Imagine the potential of Vernacular Voice Trading where a simple command, "Buying Reliance shares using voice commands in Hindi," executes the trade instantly.

Deep Dive: Read the full analysis: Why Vernacular Fintech Tools Will Dominate Voice Trading Apps India?.

The Security Frontier (The "High Stakes" Bridge)

The single biggest threat in the 2026 financial system is the rise of AI-generated identity theft: Deepfakes. As banks use Video KYC, criminals use hyper-realistic synthetic media to bypass systems. The industry is rapidly adopting Deepfake Defense & Biometric Security measures, including:

- Liveness v2.0: Sophisticated tech that proves a person is physically present, not a deepfake video.

- Behavioral Biometrics: Verifying a user's identity not by what they know (a password) or what they look like, but by how they interact with their device (e.g., how they type or hold their phone).

Deep Dive: Read the full analysis: Deepfake Defense & Biometric Security in Indian Banking.

2026: The New Financial Mandate

The AI in Indian Finance revolution is not a choice; it's a mandate. The combination of autonomous Agentic AI and mass-market Vernacular Banking is set to unlock transformative economic growth. However, this progress is contingent on mastering the Security Frontier and navigating the DPDP Act. The institutions that prepare for this transformation today will define the next decade of finance in India.

Frequently Asked Questions (FAQs)

Vernacular Banking focuses on making financial services universally accessible by providing them in India’s diverse local languages, such as Hindi, Tamil, Telugu, and Marathi. Its purpose is to break the English-language barrier that has historically excluded potential investors and customers in Tier-2 and Tier-3 cities. This initiative is crucial for achieving deeper financial inclusion, as it allows the next 100 million internet users to interact with and manage their finances using their most comfortable and natural medium—their own language.

The Digital Personal Data Protection (DPDP) Act, 2023, imposes stringent guidelines on how financial institutions use customer data, particularly in high-stakes areas like AI lending. The Act mandates strict principles of consent, transparency, and purpose limitation. This means that AI lending models must be highly responsible and ethical; they must obtain clear, informed consent from borrowers for every specific use of their personal data (like spending habits) and are increasingly required to provide explainability for any automated decision, such as denying a loan.

Deepfake Defense refers to advanced security protocols developed to combat the rising threat of AI-generated identity fraud in finance. As banks increasingly rely on digital verification methods like Video KYC, criminals use highly sophisticated synthetic media (Deepfakes) to impersonate individuals and commit fraud. Defense mechanisms include technologies like Liveness v2.0, which rigorously proves a user is a real, live human and not a fabricated image or video, and Behavioral Biometrics, which verifies identity based on unique physical interactions, such as how a user types or holds their phone.

Agentic AI dramatically shifts the function of a Chartered Accountant (CA) from a manual executor to a strategic overseer. Since the AI automates high-volume, repetitive clerical tasks like GST reconciliation and complex data entry, the CA's job transforms. They focus less on manual processing and more on high-level AI oversight, strategy, and risk management, particularly through Continuous Control Monitoring. This allows the CA to focus their expertise on validating AI-generated tax strategies and offering higher-value advisory services.

Sources and References

Back to Agentic AI and Vernacular Banking in Indian Finance 2026