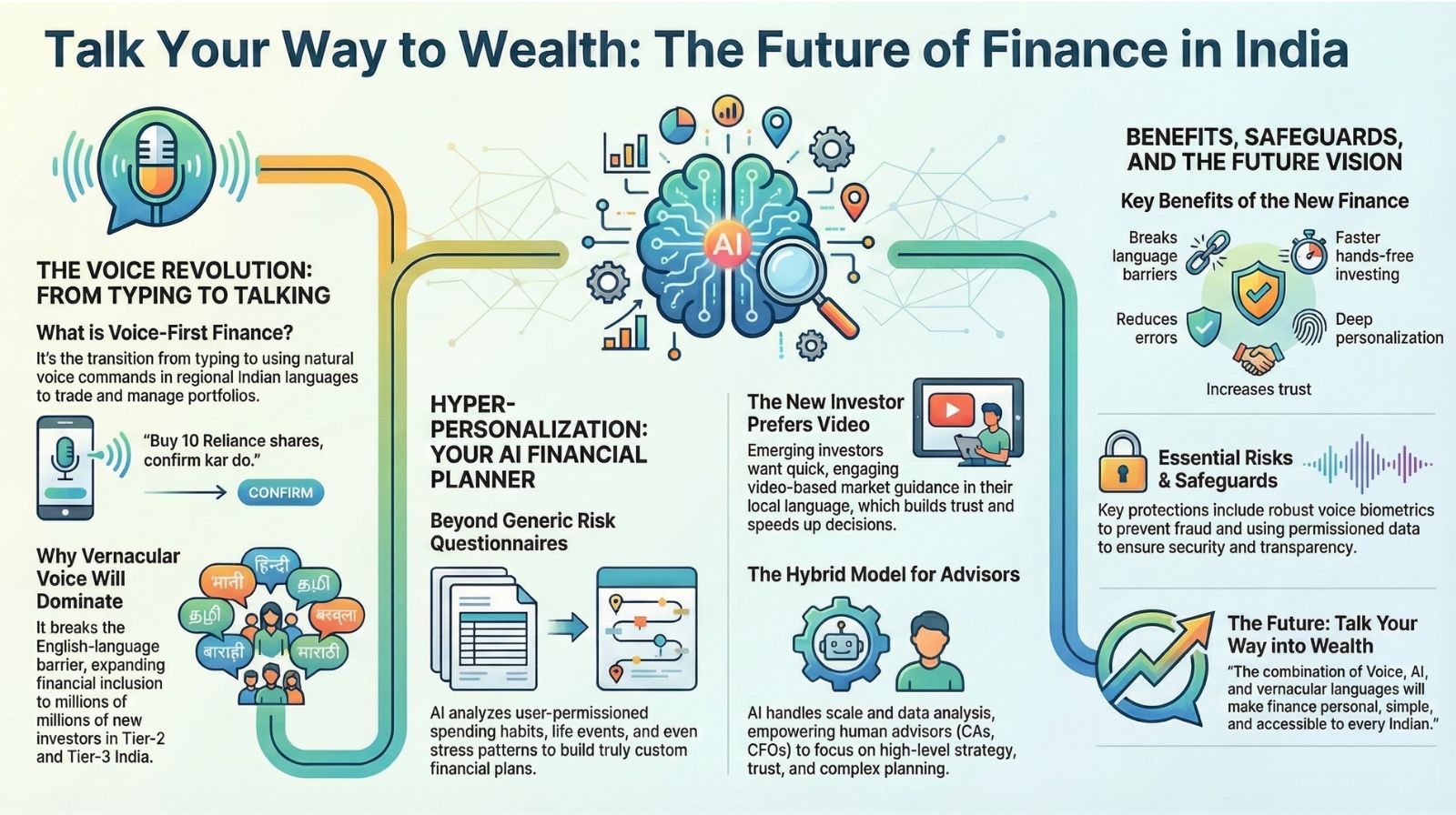

Why Vernacular Fintech Tools Will Dominate Voice Trading Apps India?

Whether you're a seasoned investor, a sharp-minded CFO, a future-focused CA, or someone just starting their first investment, you’ve probably noticed something: the world of money is changing, fast.

For the last few years, we’ve all been busy typing out our trades and searching for advice.

But in 2026, the game is shifting from text to talk.

Get ready for Voice-First Finance and truly Hyper-Personalized Wealth Management. It's not just a fancy update; it's a financial revolution built around you, in a language you love.

Related Deep Dives on Agentic AI & Finance 2026

Block 1: The End of Typing, The Rise of Talking

“Buying Reliance shares using voice commands in Hindi” - The New Investor Superpower

In India, the next big battlefield for fintech is not a sleek new app design, it's your voice.

For too long, the stock market felt like a world reserved for English speakers and complicated dashboards. Not anymore.

Imagine this: You are having your morning tea, and you simply tell your phone:

“ Hey, buy 10 Reliance shares at market price, confirm kar do .”

And just like that, the transaction is done, the trade is confirmed, and the details are updated in your portfolio. This is the power of Vernacular Voice Trading.

What is it? It's using simple, natural voice commands in Indian languages (Hindi, Marathi, Bengali, etc.) to perform complex financial transactions like buying, selling, and tracking stocks or mutual funds.

Why is it the Next Frontier? India has hundreds of millions of people who are more comfortable in their regional language than in English. Companies like Zerodha, Groww, and their competitors are racing to integrate this tech.

This move is all about financial inclusion, bringing the stock market to every corner of India, one voice command at a time. It’s making the market accessible, understandable, and human.

| Key Benefit for Retail Investors | Why It Matters |

|---|---|

| Breaks Language Barriers | You don't need to know financial English to trade. |

| Faster Decisions | A voice command is often quicker than navigating menus. |

| Reduces Errors | Simple, spoken instructions are less confusing than complex forms. |

This is what Voice Trading Apps India will be built on.

Block 2: Beyond the Risk Questionnaire

Hyper-Personalization: The AI Financial Planner That Knows Your Wallet Better Than You Do

Have you ever filled out a long, boring "risk-tolerance questionnaire" to get investment advice? Those days are over. Generic advice based on your age and salary is officially outdated.

In 2026, Hyper-Personalized Wealth means your AI Financial Planner builds your portfolio based on your real-life spending habits, not just generic answers.

How does this AI work?

It securely analyzes your aggregated and anonymized transaction data (with your permission, of course):

- Spending Patterns: Do you often splurge on travel? Do you consistently save a small amount?

- Emotional Triggers: When the market dips, do you instantly check your app (a sign of high-stress)?

- Life Events: Did you just get a home loan?

The AI instantly pivots your advice from 'aggressive growth' to 'debt management and stability'.

The Result: Truly Custom Portfolios.

Instead of a generic 'aggressive' fund, you get a portfolio tuned for a specific goal: "A tax-efficient fund for your child's 2038 university goal, adjusted for your recent high-spending travel habits."

It doesn't just ask if you are a "high-risk" investor; it knows you are a high-risk investor because you've consistently held a large portion of volatile assets.

This kind of advice is proactive and hyper-relevant, making it an indispensable Vernacular Fintech Tool for the masses, especially for AI financial planner for salary earners who need guidance on balancing expenses and investments.

Block 3: Video Advisory and the New Investor (High Volume/CPC)

The rise of high-speed internet in every town means a new type of investor is entering the market: the high-volume, cost-per-click retail investor. These investors want information that is fast, engaging, and in their own language.

Video-Based Advisory: Why read a 20-page market report when a renowned expert can give you a 3-minute video summary on your app in Hindi, explaining exactly how to adjust your portfolio for the next quarter? This combination of visual content and clear audio builds trust and speeds up decision-making for the new generation of investors.

CA/CFO Opportunity: For Chartered Accountants and CFOs, this presents a massive opportunity. Instead of just managing books, you can leverage these AI tools to offer scaled, hyper-personalized advisory services to a wider client base than ever before. This is how you transition from traditional consultant to a high-tech financial architect.

The Future is Conversational

Voice-First Finance isn't just a trend; it's the natural evolution of digital money in a diverse country like India. By tearing down the walls of language and complexity, AI is making finance personal, powerful, and accessible to everyone.

The new retail investor is not just a high-volume trader; they are a sophisticated, well-informed individual empowered by a financial assistant that speaks their language, understands their life, and guides them step-by-step.

Get ready to talk your way to wealth in 2026.

Frequently Asked Questions (FAQs)

It is the ability to use spoken commands in regional Indian languages (like Hindi, Tamil, Telugu, etc.) to execute financial transactions, such as buying stocks or mutual funds, through mobile apps or smart devices. This is crucial for financial inclusion across India.

Yes. The technology relies on user-permissioned data (data you agree to share, often via the Account Aggregator framework). This data is typically anonymized and aggregated for analysis. Reputable AI Financial Planner firms prioritize security and compliance, ensuring the data is used only to generate relevant advice, not sold or misused.

No, it will transform their role. Agentic AI tools automate routine tasks (compliance, data entry, portfolio rebalancing), freeing up CAs and financial advisors to focus on high-value activities like complex tax strategy, legacy planning, and holistic goal alignment. It creates a powerful Hybrid Model where technology handles scale, and the human expert handles trust.

The main risks are security (ensuring voice biometrics are robust against fraud) and accuracy (ensuring the AI correctly interprets the voice command, especially across different accents and dialects). Fintech companies are addressing these through advanced Voice Biometrics and sophisticated Natural Language Processing (NLP) models.