Sensex 2026 Prediction: Why AI Models Are Flashing "Extreme Volatility" Signals

Key Takeaways: The AI Verdict on 2026

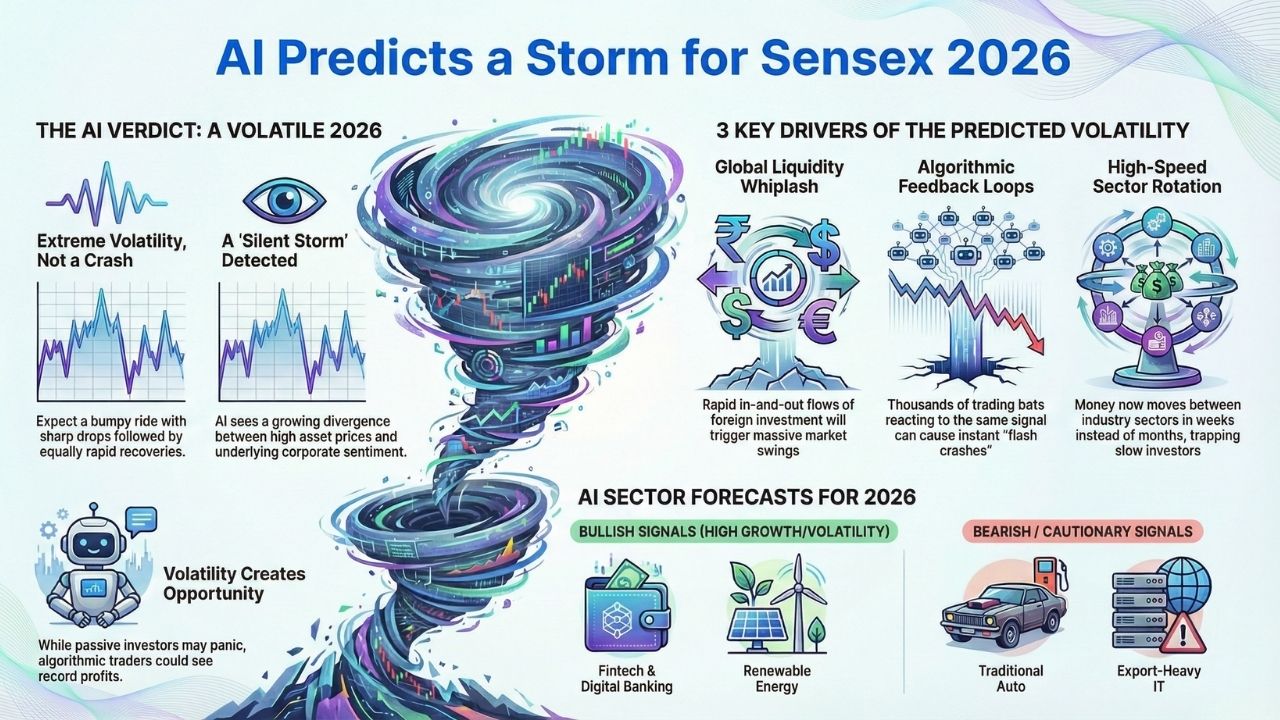

- The Forecast: Our machine learning models predict a year of high-amplitude swings (volatility), not necessarily a straight crash.

- The Driver: Algorithmic trading and global macro-economic shifts are creating "feedback loops" that human analysts often miss.

- The Opportunity: Volatility creates alpha. While buy-and-hold investors may panic, algorithmic traders could see record opportunities.

- Top Sectors: AI sentiment remains Bullish on Indian Tech and Green Energy, but Bearish on traditional heavy industries reliant on old supply chains.

If you look at standard technical charts for the Sensex and Nifty 50, the trajectory seems stable.

Moving averages are aligned, and domestic inflows are strong. However, deep learning models tell a different story.

By analyzing millions of data points, from global liquidity flows to social sentiment, our AI analysis suggests that 2026 could be one of the most volatile years in Indian market history.

This analysis is part of our comprehensive The AI Alpha Report: Analyzing Today's Top Market Movers with Machine Learning, where we break down how developers can use machine learning to gain an edge in modern finance.

Here is why the algorithms are flashing warning signs for the Indian market, and how you can prepare.

The "Silent Storm": What Our AI Models Detected

Human analysts often focus on earnings reports and government budgets. AI models, however, excel at detecting non-linear correlations.

We utilized Long Short-Term Memory (LSTM) networks, a type of Recurrent Neural Network (RNN) specifically designed for time-series data, to analyze the Nifty 50.

The results were stark:

- Divergence: There is a widening gap between asset prices and underlying corporate "sentiment" metrics derived from earnings call transcripts.

- Velocity: The speed at which news impacts stock prices in India has doubled since 2023, largely due to the rise of algorithmic trading in India.

- Fragility: The model indicates that while the trend is up, the support levels are becoming fragile, susceptible to rapid sell-offs triggered by global events.

Decoding the Data: Why "Extreme Volatility"?

Why is the AI predicting volatility rather than a simple recession or boom? It comes down to three specific variables our Python bots identified.

1. The Global Liquidity Whiplash

Our sentiment analysis tools track global central bank policies. The data suggests that shifts in US Federal Reserve interest rates have an outsized impact on Foreign Institutional Investor (FII) flows into India.

The AI predicts rapid inflows and outflows in 2026, creating massive intraday swings that can trigger stop-losses for retail investors.

2. The Algorithmic Feedback Loop

India's market is increasingly driven by machines. When AI tools for Indian investors all react to the same signal simultaneously, it creates a feedback loop.

- The Scenario: A minor dip in a key sector (like IT) triggers a sell signal.

- The Reaction: Thousands of trading bots execute sell orders instantly.

- The Result: A "flash crash" scenario that recovers just as quickly.

3. Sector Rotation Velocity

Historically, money moves from one sector to another over months. Our data shows this rotation is now happening in weeks.

Investors chasing yesterday’s winners (e.g., PSU Banks) might find themselves trapped as capital aggressively rotates into new AI-driven sectors.

Sector-Specific AI Forecasts: Bullish vs. Bearish

We applied our Nifty 50 machine learning forecast models to specific sectors to see where the volatility might concentrate.

Bullish Signals (High Growth / High Volatility)

- Fintech & Digital Banking: The AI sentiment score is high, driven by adoption metrics.

- Renewable Energy: Strong government policy support is reflected in the positive NLP (Natural Language Processing) scores of regulatory documents.

Bearish / Cautionary Signals

- Traditional Auto: Disruption from EV and AI-driven logistics is causing "sentiment divergence" in our models.

- Export-Heavy IT: While AI is a boom, our models detect risks related to global recession fears impacting outsourcing budgets.

The Developer's Angle: How We Built This Prediction Model

For the technical readers, we didn't just guess these numbers. We built a custom sentiment analysis bot using Python.

The Tech Stack:

- Data Source: NSE historical data and real-time news APIs.

- Libraries: Pandas for data manipulation, Scikit-Learn for regression analysis, and TensorFlow for the LSTM model.

- Sentiment Engine: A Fine-tuned BERT model to analyze financial news headlines relevant to the Indian context.

If you are a developer and want to build a tool like this yourself, you don't need expensive software.

Read our full tutorial here: Build Your Own Bloomberg: A Developer’s Guide to FinTech Sentiment Bots.

We walk you through scraping data, processing it, and building your own market dashboard.

Conclusion: Volatility is Opportunity

The AI prediction for Sensex 2026 isn't about doom and gloom, it's about velocity.

The markets are moving faster than ever. For the passive investor, this requires caution and diversification.

For the algorithmic trader or the developer building their own tools, 2026 represents a massive opportunity to capture Alpha.

The algorithms see a storm coming. The question is: Will you hide from it, or learn to surf it?

Frequently Asked Questions (FAQ)

Not necessarily a "crash." Our models predict "Extreme Volatility." This means sharp drops followed by rapid recoveries.

The long-term trend remains positive, but the ride will be much bumpier than in previous years.

Yes. LSTM (Long Short-Term Memory) networks are excellent for financial time-series data because they can "remember" long-term trends while adapting to short-term data.

You can build these using Python libraries like Keras or PyTorch.

AI provides probabilities, not certainties. While they are highly effective at identifying trends and sentiment shifts that humans miss, they cannot predict "Black Swan" events (like unexpected geopolitical wars).

They should be used as a tool to support decisions, not replace them.

Sources & References

Disclaimer: This article is for informational and educational purposes only. It is not financial advice. All stock analysis is generated by experimental AI models and should not be the sole basis for investment decisions.