Best AI LLC Formation Services 2026: Automate Delaware & Wyoming Setup

Key Takeaways: Quick Answer

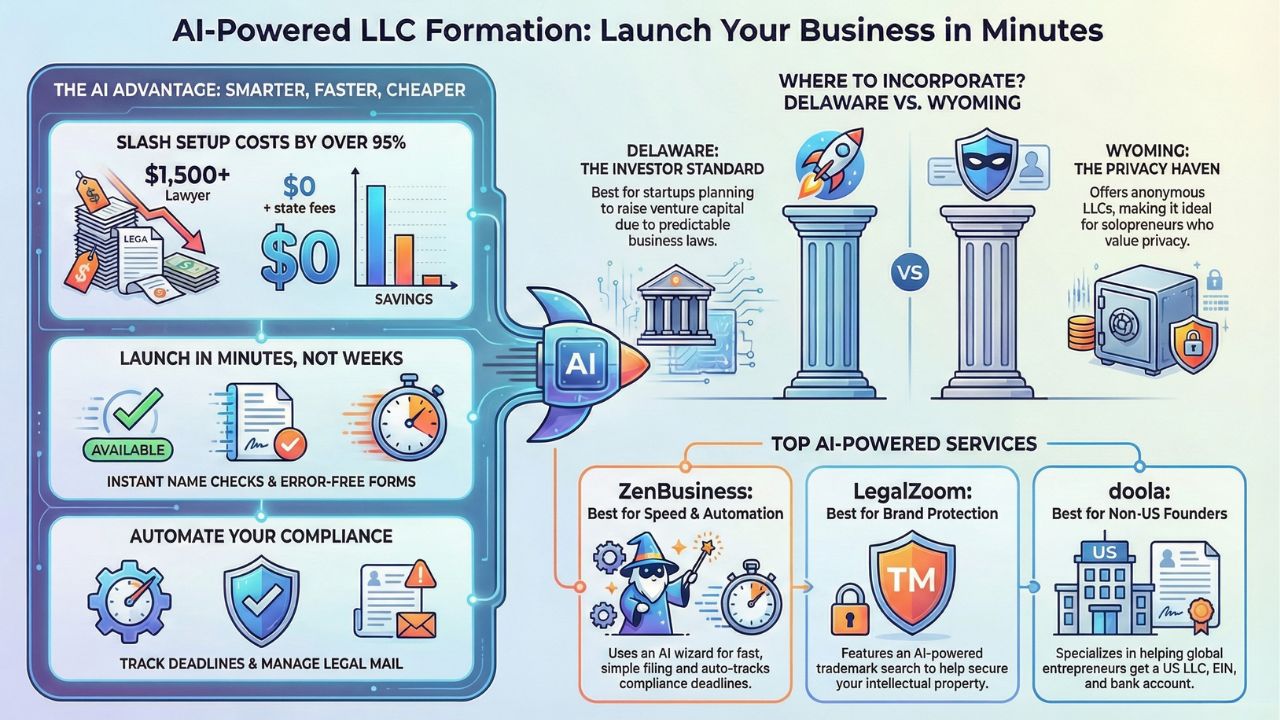

- Best for Speed: ZenBusiness (Uses AI to auto-fill state forms in minutes).

- Best for Brand Protection: LegalZoom (AI trademark search included).

- Best for Non-Residents: doola (Specializes in US LLCs for global founders).

- Top States: Delaware (Investor friendly) vs. Wyoming (Privacy & low fees).

- Cost Savings: AI tools reduce setup costs from $1,500+ (Lawyer) to $0 + State Fees.

Stop Paying Lawyers for Paperwork

Starting a company used to require expensive lawyers and days of waiting. In 2026, AI has changed the game.

You can now incorporate a US-based LLC in minutes using automated compliance engines.

These tools don't just fill out forms. They check for name availability, file with the state, and generate your Operating Agreement instantly.

This guide explores the best AI-driven services to launch your business today.

It is a crucial chapter in our wider AI Wealth & Infrastructure 2026 Hub, helping you build a "Defense" strategy for your assets.

Why Use AI for LLC Formation?

The old way of forming an LLC involved printing PDFs, mailing checks, and waiting weeks.

AI formation services automate the entire backend process.

- Error-Free Filing: AI scans your application for common errors before submission.

- Instant Name Checks: Natural Language Processing (NLP) checks state databases instantly to see if your business name is free.

- Registered Agent Bots: Automated systems receive your legal mail and scan it to your dashboard immediately.

If you are serious about AI Wealth & Infrastructure, you need a legal entity to separate your personal assets from your business risks.

Delaware vs. Wyoming: Which is Best for AI Solopreneurs?

Before choosing a tool, you must choose a state.

Most digital entrepreneurs and AI start-ups narrow it down to two options.

1. Delaware (The Investor Standard)

- Best for: Startups planning to raise venture capital or sell shares.

- Why: Delaware has a separate court system for businesses (Chancery Court). Investors prefer it because the laws are predictable.

- Cost: Higher franchise taxes annually.

2. Wyoming (The Privacy Haven)

- Best for: Solopreneurs, dropshippers, and crypto traders.

- Why: Wyoming offers "Anonymous LLCs." Your name does not appear on the public record.

- Cost: Very low annual fees.

Pro Tip: Once your LLC is active, you must manage your finances correctly. Use the Best AI Tax Software 2026 to handle your yearly filing and avoid IRS audits.

Top 3 AI LLC Services Reviewed

We tested the top platforms to see which ones actually use automation to save you money.

1. ZenBusiness (Best Overall Automation)

ZenBusiness uses extensive automation to keep prices low.

Their wizard guides you through the process in simple English. You don't need to know legal jargon.

- AI Feature: Their "Worry-Free Compliance" bot tracks your annual report deadlines automatically.

- Speed: Fast filing options available.

- Price: Starts at $0 + State Fees.

2. LegalZoom (Best for Brand & IP)

LegalZoom is the giant of the industry, but they have recently integrated AI to speed up operations.

- AI Feature: AI-powered trademark search helps you ensure your brand name isn't stealing someone else's IP.

- Protection: Excellent if you are worried about copycats.

Note: If you are worried about identity theft or deepfakes harming your brand reputation, consider Personal Deepfake Insurance Claims as your next step.

3. doola (Best for Non-US Founders)

If you live outside the US but want a US LLC, doola is the gold standard.

They handle the EIN (Employer Identification Number) process with the IRS, which can be a nightmare for non-citizens.

- Banking: They help you set up a US bank account remotely.

- Compliance: specialized in cross-border tax automated support.

What Happens After You Incorporate?

Forming the LLC is just the first step in your "Defense" strategy.

Once your have your EIN and bank account, you need to put your money to work and protect it.

1. Automate Your Investing

Don't let your corporate profits sit in a checking account losing value to inflation.

Use corporate trading accounts to grow your capital. Check out our guide on Top 5 AI Stock Trading Bots to find bots that are compatible with business accounts like Robinhood or Webull.

2. Prepare for Tax Season

An LLC requires strict separation of finances.

You cannot mix personal groceries with business software costs. If you mess this up, you risk "piercing the corporate veil."

We highly recommend reading our review of AI Tax Audit Agentsto keep your books clean from Day 1.

Conclusion

Building a business infrastructure is the difference between a "hustle" and a "company."

By using AI formation services, you can set up a Delaware or Wyoming LLC in an afternoon for a fraction of the cost of a law firm.

Secure your legal shield today. Then, focus on growing your wealth.

Next Step: Now that your legal entity is secure, ensure your financial house is in order. Read our comparison of the Best AI Tax Software 2026.

Frequently Asked Questions (FAQs)

Yes, for standard business setups. If you have complex partnership agreements or millions in assets, hire a lawyer. For a standard solopreneur LLC, AI services are faster and cheaper.

No. You can live anywhere in the world. You simply need a "Registered Agent" in that state, which services like ZenBusiness provide as part of the package.

Generally, yes. The costs of starting your business (up to $5,000) can often be deducted. However, always consult your AI Tax Software or a CPA to confirm.