Why High-Net-Worth Families Need Deepfake Insurance??

Introduction: The "Virtual Kidnapping" of 2026

It starts with a phone call. It’s your daughter’s voice.

She’s crying, terrified, saying she’s been in a car accident or arrested in Mexico. She needs $50,000 wired immediately.

You panic. You wire the money.

An hour later, your daughter walks through the front door, confused. She was at the gym.

You didn't speak to her; you spoke to an AI clone trained on her TikTok videos.

This is not science fiction. In 2026, voice cloning fraud protection is the #1 security need for high-net-worth families.

Wealth makes you a target, and AI makes the scams uncatchable.

Welcome to the era where you need insurance not just for your house, but for your reality.

Explore the AI Wealth & Legal Defense Hub

What is "Deepfake Insurance"?

Traditional cyber insurance protects you if your credit card is stolen.

Deepfake insurance coverage for individuals protects you when your identity is weaponized.

Leading insurers like Coalition and Chubb have introduced "Deepfake Response Endorsements" to cover losses that standard policies exclude.

These are no longer just business policies; they are being adapted for private clients.

The Critical Clause: "Social Engineering Fraud"

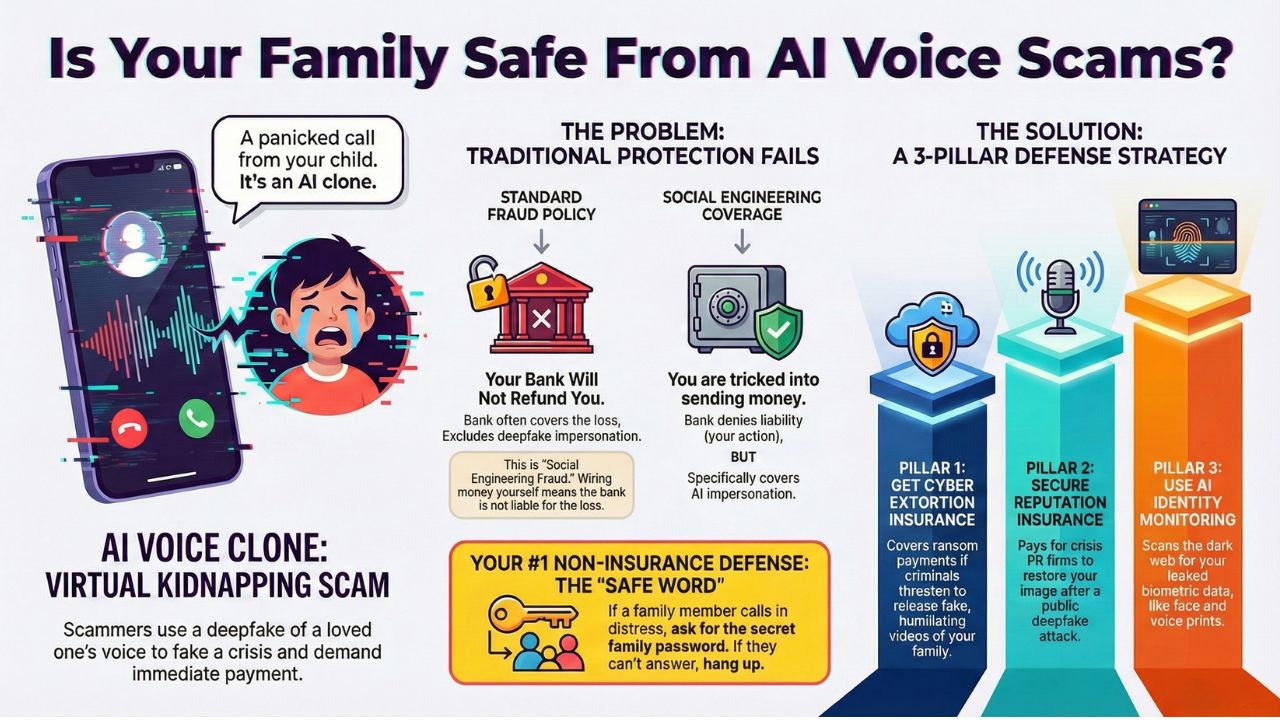

Most people think their bank refunds them if they get scammed. Wrong.

If you voluntarily wire money because you were tricked by a deepfake, the bank is not liable.

This is called "Voluntary Parting."

You need a policy with specific social engineering fraud coverage.

This covers the financial loss when you are manipulated into parting with your money by an AI impersonator.

Standard Fraud vs. Social Engineering Fraud:

| Feature | Standard Fraud Policy | Social Engineering Endorsement |

|---|---|---|

| Trigger | Your account is hacked directly | You are tricked into wiring money |

| Liability | Bank often refunds (FDIC/insurance) | Bank denies liability (your fault) |

| Deepfake Cover | No (usually excluded) | Yes (covers AI impersonation) |

| Limit | Typically $5k - $10k | Can be $250k - $1M+ |

The 3 Pillars of Family Protection Against Deepfakes

When reviewing personal cyber insurance for families 2026, look for these three specific clauses:

1. Cyber Extortion Insurance (The Ransom Shield)Hackers are no longer just locking your files; they are threatening to release humiliating (fake) videos of you or your children unless you pay.

- The Threat: "Sextortion" deepfakes targeting teenagers or executives.

- What it covers: Reimbursement for ransom payments and the cost of professional negotiators to handle the extortionist.

A competitor creates a deepfake video of you saying racist slurs. It goes viral. Your business partners panic.

- What it covers: The cost of hiring a Crisis PR firm to scrub the internet, issue legal takedowns, and restore your public image.

- This is essential reputation insurance for individuals.

- Real-World Cost: Professional digital cleanup can cost $50,000+ per month. Insurance covers this.

It’s not just about credit scores anymore. It’s about "Synthetic Identity Fraud", where criminals combine your real social security number with a fake AI face to open accounts.

- The Defense: High-end policies now include active AI identity theft monitoring that scans the dark web for biometric data leaks (face prints and voice prints).

Practical Defense: The "Safe Word" Strategy

Insurance pays you back, but prevention saves you trauma.

Every high-net-worth family needs a "Voice Password."

How to implement it?

- Choose a Word: Pick a random word (e.g., "Purple Flamingo") that you never use in public.

- The Rule: If a family member calls in distress asking for money, ask for the Safe Word.

- The Trap: If the caller (AI) ignores the question or gets angry, hang up. It’s a scam.

- Pro Tip: Combine insurance with active defense tools.

Conclusion: Insuring Your Truth

The "AI Fortress" isn't complete without a moat. You have built wealth using Trading Bots and protected it with Legal AI.

Now, you must insure your reputation against the chaos of the digital world.

Don't wait for the call to happen. Update your policy today.

Frequently Asked Questions (FAQs)

Rarely. Standard homeowners policies might cover simple identity theft ($5k limit), but they usually exclude "voluntary parting" of funds (social engineering) and reputation damage. You need a standalone personal cyber insurance policy.

Standalone personal cyber policies for high-net-worth families typically range from $1,000 to $5,000 per year for $1M+ in coverage. It depends on your public profile and asset value.

It helps, but it's not perfect. Banks are using voice biometrics, but AI voice clones are now bypassing these checks. Insurance is your fail-safe when technology fails.