Best AI Tax Software 2026 for US Solopreneurs: TurboTax vs. AI Agents

The 2026 tax season is different. With the IRS introducing new inflation adjustments and the "One Big Beautiful Bill" Act reshaping overtime and tip taxation, the old method of manually filling out forms is dangerous.

This review helps you choose the right filing engine to finalize your year.

Important: This review is part of our comprehensive AI Wealth & Business Infrastructure 2026 guide.

While our AI Bookkeeping Guide covers daily expense tracking, this page focuses exclusively on the high-stakes "Game Day", filing your Schedule C and paying the IRS.

The 2026 Shift: From "Software" to "Tax Agents"

For decades, tax software was just a digital form; you still had to know what to enter. In 2026, we have "Tax Agents."

These tools don't just record data; they hunt for it. They connect to your plaid-linked bank accounts, scan 12 months of transactions in seconds, and argue for deductions you didn't know existed (like the home office "safe harbor" or partial internet bills).

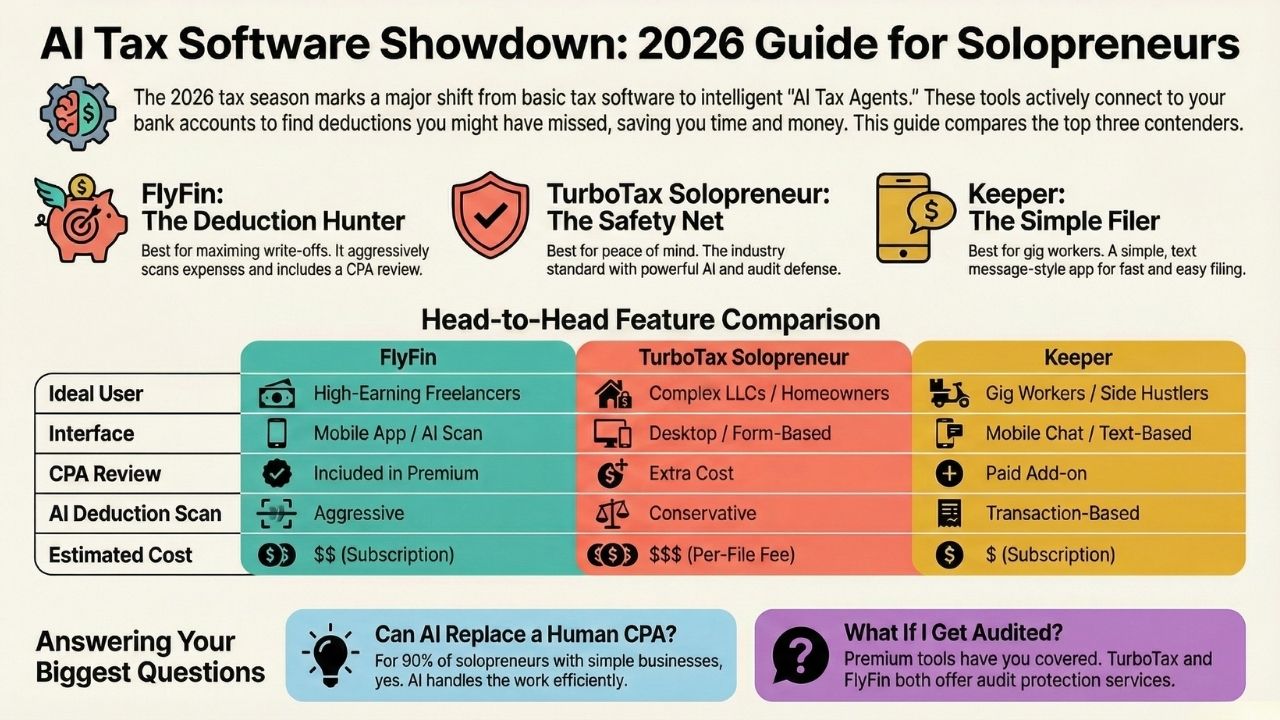

If you are a US-based Solopreneur, Freelancer, or LLC owner, you have three main contenders this year.

Quick Answer: Which Tool Should You File With?

- Best For Maximum Deductions (The "AI Agent"): FlyFin. It uses generative AI to scan every line of your bank statements for hidden 1099 write-offs and includes CPA review.

- Best For Peace of Mind (The "Safety Net"): TurboTax Solopreneur. Expensive, but their "Audit Defense" and new 2026 AI assistant are unmatched for complex returns.

- Best For Budget/Mobile Users: Keeper. A simple, text-message-based interface that feels like chatting with a friend, perfect for gig workers (Uber/DoorDash).

1. FlyFin: The "24/7 AI Accountant" (Best Overall)

FlyFin is not just software; it is a "man-plus-machine" hybrid designed specifically for the 1099 economy.

How It Works:

You link your expenses. FlyFin’s AI (A.I. Tax Engine) scans them and categorizes them as "Business" or "Personal." If it’s unsure, it asks you.

Why It Wins for Solopreneurs:

- The "Deduction Hunter": It finds obscure write-offs. Did you buy a coffee for a client meeting? FlyFin flags it.

- CPA Review Included: Unlike standard software, FlyFin’s higher tiers include a review by a real human CPA before you file.

- Audit Insurance: They offer full audit representation, meaning they deal with the IRS so you don’t have to.

The Downside:

It is mobile-first. If you prefer sitting at a large desktop monitor with spreadsheets open, the interface might feel too "app-like."

2. TurboTax Solopreneur: The "Legacy King" (Best for Safety)

TurboTax has finally realized that solopreneurs are a massive market. Their 2026 "Solopreneur" edition is a significant upgrade from the generic "Self-Employed" version of the past.

The New AI Features:

- Intuit Assist: Their generative AI assistant now sits on the sidebar. You can ask, "Is my Spotify subscription deductible if I play it in my waiting room?" and it cites specific IRS codes.

- Import Power: It seamlessly pulls 1099-NEC and 1099-K forms from major platforms like Uber, Upwork, and Amazon.

Why It Wins:

- Reliability: When you file with TurboTax, you are using the industry standard.

- Security: Their "Audit Defense" is arguably the strongest legal shield available for retail investors.

(Note: If you are an active investor, ensure your tax strategy aligns with your trading tools. See our guide on Top 5 AI Stock Trading Bots 2026 for compatible platforms).

The Downside:

Price. TurboTax is notorious for "opaque pricing." You start free, but by the time you add State Filing and Audit Defense, you could be paying $150–$200+.

3. Keeper: The "Text Message" Filer (Best for Gig Workers)

Keeper (formerly Keeper Tax) takes a radically different approach. It feels less like accounting software and more like texting a smart friend.

How It Works:

Keeper connects to your bank feed and sends you occasional texts or notifications: "Hey, you spent $54 at Shell. Was this for work?" You reply "Yes," and it logs the write-off.

Why It Wins:

- Simplicity: There are no complex dashboards.

- Speed: You can file your taxes directly through the app in under 20 minutes if your books are clean.

- Price: It is generally more affordable than TurboTax.

The Downside:

It lacks the heavy-duty complexity handling of TurboTax. If you have assets to depreciate (like real estate) or complex K-1 forms, Keeper might be too simple.

Comparison: Feature & Pricing Breakdown

| Feature | FlyFin | TurboTax Solopreneur | Keeper |

|---|---|---|---|

| Primary Interface | Mobile App / AI Scan | Desktop / Form-Based | Mobile Chat / Text |

| Ideal User | High-earning Freelancers | Complex LLCs / Homeowners | Gig Workers / Side Hustlers |

| AI Deduction Scan | Excellent (Aggressive) | Good (Conservative) | Good (Transaction based) |

| CPA Review | Included in Premium | Extra Cost (Live Assist) | Paid Add-on |

| Est. Cost | $$ (Subscription) | $$$ (Per File Fee) | $ (Monthly/Yearly) |

Conclusion

For the 2026 tax season, don't just "file" your taxes, optimize them.

- If you want to squeeze every legal dollar out of your expenses, go with FlyFin.

- If you want the "sleep well at night" brand name, pay the extra cash for TurboTax Solopreneur.

- If you want to get it done while waiting in line for coffee, download Keeper.

Next Step: Secure Your "Financial Defense" Stack

Once your taxes are filed, you need to protect and grow that wealth. A tax return is just one pillar of your business infrastructure.

- Legitimize Your Business: If you filed as a sole prop this year, consider upgrading to an LLC for better liability protection next year. Read our review of the Best AI LLC Formation Services 2026.

- Grow Your Capital: Put your tax refund to work using automation. Check out our updated guide on Top 5 AI Stock Trading Bots 2026: Robinhood & Webull Compatible.

- Protect Your Identity: As your financial footprint grows, so does your risk profile. Ensure you are covered against digital identity theft with Personal Deepfake Insurance Claims.

Frequently Asked Questions (FAQs)

Yes, but with a caveat. AI is excellent at data entry and pattern recognition (finding deductions). However, AI can "hallucinate." You should never use an AI tool that auto-submits without your final review. All the tools listed above require you to sign off before the data goes to the IRS.

For 90% of solopreneurs? Yes. If your business is simple (Service income, standard expenses, home office), a CPA charging $500–$1,000 is overkill. Exception: If you have foreign income, multiple rental properties, or corporate S-Corp election complexities, keep the human CPA for strategy, but use AI for the grunt work.

This is the biggest fear for solopreneurs. TurboTax offers "Audit Defense" (they represent you). FlyFin offers similar protection in their premium tiers. If you use a free or budget tool without audit protection, you are on your own to answer IRS letters.