AI Tax Audit Agents for Solopreneurs

Introduction: The "Invisible Auditor"

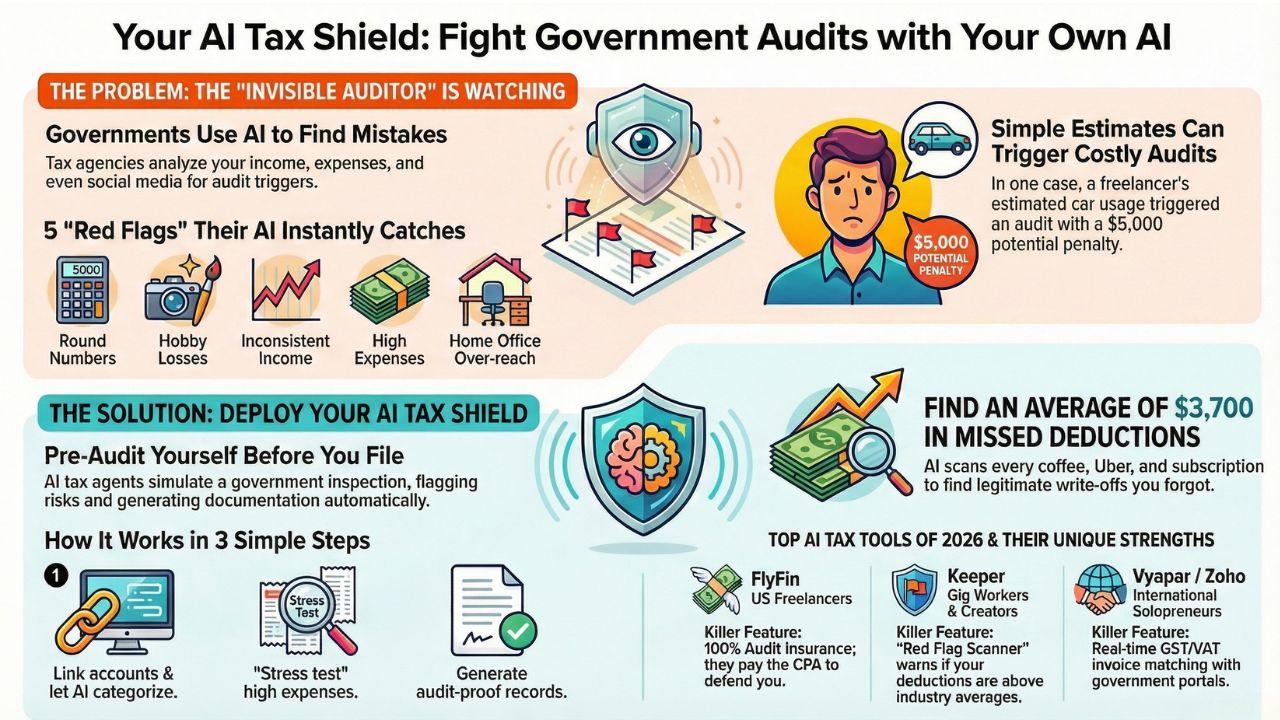

For years, the IRS and Income Tax Departments have used AI to flag your returns. They know if your "Home Office Deduction" is suspiciously large compared to your income. They use predictive tax liability AI to spot anomalies before a human officer even opens your file.

Until now, you were bringing a calculator to a gunfight.

In 2026, the tables have turned. You can now use AI tax audit defense software to "pre-audit" yourself.

These agents simulate a government inspection before you file, flagging risky deductions and generating bulletproof documentation automatically. This isn't just bookkeeping; it's self-employed tax automation with a shield.

Explore the AI Wealth & Legal Defense Hub

The "AI vs. AI" Arms Race

Why is this urgent now? Because tax authorities globally (IRS in the US, HMRC in the UK, IT Dept in India) have deployed "Project Insight" style algorithms.

These bots scan your social media, bank transactions, and property records to find "Lifestyle Mismatches", where you spend more than you earn.

To survive, you need your own AI agent that understands these algorithms better than they do.

The Top 3 AI Tax Tools for 2026 (Deep Dive)

We reviewed the best AI tax software for freelancers 2026 to find the ones that don't just file, but protect.

1. FlyFin (Best for US Freelancers & Audit Defense)FlyFin is the gold standard for automated tax deduction finder technology. It connects to your bank, scans expenses, and uses an "Audit Risk Analyzer" to tell you if a deduction is safe.

How it Works: It uses a "Man + Machine" model. The AI categorizes 95% of expenses, and a human CPA reviews the tricky 5%.

Killer Feature: 100% Audit Insurance. If the AI makes a mistake, they pay for the CPA to defend you in court.

Best For: US-based solopreneurs worried about the IRS.

Price: ~$29/month (includes filing).

2. Keeper (Best for "Red Flag" Detection)Keeper works natively via text message and app. It actively monitors your spending and asks, "Was this coffee a client meeting?" It builds a dossier of evidence all year long.

How it Works: It scans your bank statements for "missed" write-offs that traditional software ignores (like a portion of your Wi-Fi or Spotify if used for work).

Killer Feature: The "Red Flag Scanner." It warns you if your write-offs (like travel or meals) are higher than industry averages for your specific job title, helping you avoid tax audit with AI.

Best For: Gig workers, creators, and digital nomads.

3. Vyapar / Zoho Books (Best for Automated GST Filing Agents)For our readers in VAT/GST jurisdictions (like India, UK, Canada), automated GST filing agents are essential.

How it Works: It automates the matching of your purchase invoices with your supplier's filings.

Killer Feature: Real-Time Reconciliation. It matches your invoices with government portals (like GSTN) instantly. If a supplier hasn't filed their taxes, the AI alerts you before you pay them, saving you from Input Tax Credit (ITC) loss.

Best For: International solopreneurs managing sales tax.

Case Study: How "Sarah" Dodged a $5,000 Penalty

Sarah is a freelance graphic designer earning $80,000/year.

The Old WaySarah manually entered receipts into Excel. She estimated her "Business Use of Car" at 80%.

The Risk: The IRS/Tax Dept algorithm flags "80%" as suspiciously high for a designer who works from home.

Result: Audit triggered.

The AI WaySarah used Keeper.

Tracking: The app tracked her actual GPS mileage automatically. It found her usage was actually 42%.

The "Pre-Audit": The AI flagged a $2,000 "Office Supply" expense (a new laptop) and asked her to upload the invoice immediately, not next year.

The Result: When she filed, her return had perfect documentation attached. She paid slightly more tax on the car but saved $5,000 in potential penalties and interest by avoiding the "red flag" deduction.

Tutorial: How to "Red Team" Your Return (Step-by-Step)

Don't wait for the letter in the mail. Use IRS compliance tools for solopreneurs to run a simulation today.

Step 1: The "Data Dump"Link your business bank accounts to an AI bookkeeping for taxes tool. Let it categorize 12 months of data. Do not manually categorize yet, let the AI find the patterns first.

Step 2: The "Stress Test"Ask the AI (or use the built-in "Review" feature):

"Review my Schedule C / Profit & Loss. Flag any expense category that is more than 20% of my total revenue."

Why? High expenses relative to income are the #1 audit trigger. If your travel costs are 50% of your income, you look like you are funding a vacation, not a business.

Step 3: Generate "Audit-Proof" ProofIf you claimed a business lunch, a credit card strip is not enough.

The AI Fix: Use the tool to attach the receipt and generate a memo stating: "Lunch with Client X to discuss Q3 Strategy." The AI does this by cross-referencing your Google Calendar with your credit card timestamp.

5 "Red Flags" AI Will Catch For You

Using real time tax monitoring tools, you can spot these errors instantly:

- The "Lifestyle" Deduction: Trying to write off gym memberships, casual clothes, or groceries. AI knows the tax code better than you and will auto-block these "personal" expenses.

- The "Round Number" Error: Filing expenses like "$500" or "$1,000" looks fake to government computers. AI uses exact numbers ($499.87) to prove accuracy.

- Inconsistent Income: If your bank deposits don't match your reported revenue (e.g., you forgot a PayPal account), predictive tax liability AI will scream at you to fix it before filing.

- The "Hobby Loss" Rule: If you show a loss for 3 years in a row, the IRS calls it a hobby, not a business. AI agents will warn you if your profit margins are dangerously low.

- Home Office Over-reach: Claiming 50% of your house as a "Home Office" when you only use one room. AI calculates the exact square footage percentage to keep you safe.

Conclusion: Tax Planning with AI Agents

The goal of the AI Fortress isn't to evade taxes; it's to pay exactly what you owe and not a penny more, without the fear of a penalty.

By using AI tax audit defense software, you sleep better. You have a digital paper trail, a pre-verified return, and an AI bodyguard standing between you and the tax man.

You have now built the full stack: Wealth Generation, Legal Protection, Risk Management, and Tax Compliance. You are a Sovereign Solopreneur.

Frequently Asked Questions (FAQ)

For 90% of routine solopreneurs, yes. AI bookkeeping for taxes handles the math and categorization faster than a human. However, for complex strategy (like moving countries, selling a business, or setting up an S-Corp), you still need a human expert to review the AI's work.

Yes. Top-tier tools like FlyFin and Keeper use bank-grade encryption (256-bit SSL) and "Read-Only" access. They cannot move your money; they can only read the transaction data to find deductions.

Tools like FlyFin are US-focused. If you need automated GST filing agents, look at Zoho Books, Vyapar, or ClearTax, which are built specifically for those tax regimes and integrate with government portals.

Yes, by finding legitimate deductions you forgot. Users of AI tax tools often find an average of $3,700 in missed write-offs because the AI scans every single coffee, Uber ride, and software subscription for business relevance.