Top 5 AI Stock Trading Bots 2026: Robinhood & Webull Compatible

Introduction: The "Set and Forget" Revolution for US Investors

Remember the old way of trading? Staring at charts for hours, stressing over every dip, and finally selling at the wrong time because of panic?

That era is over. But for US investors, the challenge has always been compliance. You want tools that work with your trusted apps, not shady offshore crypto bots.

In 2026, safe AI stock tools USA have finally arrived. We are moving beyond experimental scripts to fully regulated trading bots that integrate with major platforms.

This guide reviews the best AI bots that are compatible with the ecosystems of Robinhood and Webull. Whether you are looking for a Webull automated bot solution or Robinhood AI trading signals, this guide covers the tools that serve as your private, compliant banker.

Explore the AI Wealth & Infrastructure Hub

Why You Need a Regulated AI Trading Agent?

Most people lose money in the stock market because of emotion. AI doesn't have feelings. It doesn't get greedy, and it doesn't panic.

- Safety First: Unlike "black box" crypto bots, the tools we list here respect US regulations. They focus on safe AI stock tools USA compliance, meaning your money stays in your brokerage account, not on some random server.

- Predictive Power: Using predictive AI for stock market trends, these bots can analyze millions of data points, news, earnings calls, and price action, faster than any human.

Top 5 AI Investment Bots & Tools (The Breakdown)

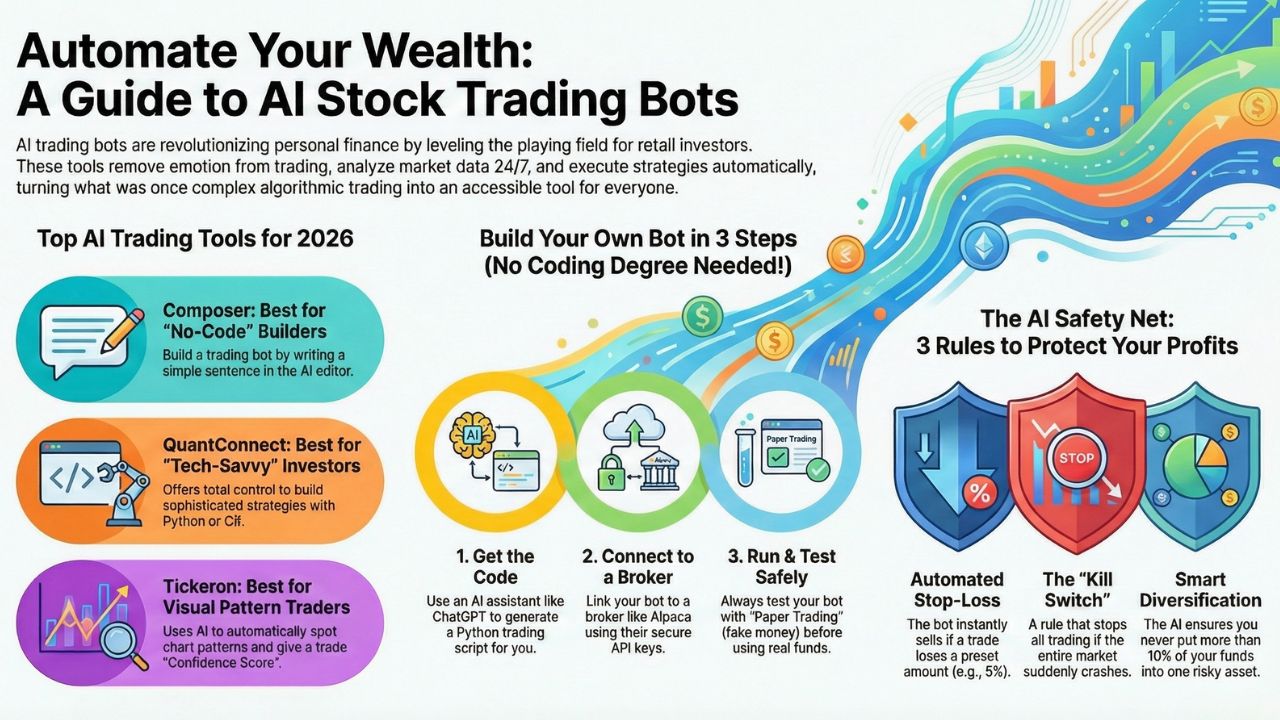

Here is our comparison of the top tools to automate your wealth, specifically selected for US market compatibility.

1. Composer (Best for Regulated "No-Code" Trading)Composer is the standout winner for 2026 for US investors. It is an SEC-registered investment advisor, making it one of the safest options available.

- How it works: You use an AI editor to type strategies like "Buy Bitcoin when it drops 5%." It then executes these trades automatically.

- Broker Compatibility: It connects directly to Alpaca and Schwab. While it doesn't link directly to Robinhood yet, it is the best alternative for those who want the "Robinhood experience" but with actual automation.

- Best For: Beginners who want regulated trading bots 2026 without learning Python.

If you absolutely must keep your money in Robinhood or Webull, Tickeron is your solution. It doesn't move your money; it tells *you* when to move it.

- The Robinhood Connection: Tickeron uses AI to spot patterns. You set up push notifications. When the AI screams "Buy," you open your Robinhood app and execute. It’s "AI-Assisted" rather than fully automated, keeping you in control.

- Best For: Robinhood AI trading enthusiasts who want AI intelligence but prefer manual execution safety.

For the tech-savvy, QuantConnect is the industry standard. It allows you to build sophisticated strategies in Python.

- The Webull Connection: Webull has an API that advanced users can leverage. QuantConnect provides the engine to build the strategy that drives that API connection.

- Pros: Access to institutional-grade data and backtesting.

- Best For: Those who want a true Webull automated bot and aren't afraid of coding.

Kavout uses a "K Score" to rate stocks. It’s less of a day-trader and more of a portfolio manager, perfect for long-term US investors building an IRA or 401k strategy.

5. Trade Ideas (Best for Day Trading Scanners)This is the tool for active US day traders. It connects with E*TRADE and Interactive Brokers. It scans the market for "Gap Ups" and high momentum, serving as the ultimate radar for your manual trades.

DIY Guide: Build Your Own Python Bot (For Non-Coders)

You might think, "I can't code." In 2026, that doesn't matter. You can now build Python trading bots for non-coders using AI assistants like Claude or ChatGPT.

Step 1: Get the CodeGo to ChatGPT or Claude and paste this prompt:

"Write a Python script for a simple trading bot using the Alpaca API. The strategy is: Buy Apple (AAPL) stock if the 50-day moving average crosses above the 200-day moving average (Golden Cross). Sell if it crosses below. Include risk management code to stop trading if I lose 2% in a day."Step 2: Connect to a Broker

You need a broker that lets bots "talk" to it. Alpaca and Interactive Brokers are the best for this. Get your "API Key" and "Secret Key" from their dashboard.

Step 3: Run and TestPaste the code into a free tool like Google Colab or run it on your laptop. Always start in "Paper Trading" mode (fake money) to test it first!

The Safety Net: Risk Management AI for Trading

Earning money is great, but keeping it is better. This is the core of our "Defense" strategy. Never deploy a bot without these three rules:

- Stop-Loss Automation: If a trade loses 5%, the AI sells instantly. No questions asked. This prevents a bad day from becoming a bankrupt day.

- The "Kill Switch": Your bot should have a rule to stop all trading if the market crashes (e.g., if the S&P 500 drops 3% in one hour).

- Diversification: The AI ensures you never have more than 10% of your cash in a single risky asset.

Pro Tip: If you are learning how to use AI for day trading, start with a "Paper Trading" account. This lets your bot trade with fake money first so you can verify it works before risking your life savings.

Conclusion: Your Sovereign Finance Future

The future of personal finance isn't about trusting a guy in a suit; it's about trusting the code you control. By using regulated trading bots 2026 compatible with platforms like Robinhood and Webull, you stop gambling and start operating like a bank.

Ready to secure the wealth you just generated? You need to protect it from lawsuits and digital threats.

Frequently Asked Questions (FAQ)

Yes, but mostly via signal-based apps. Tools like Tickeron analyze the market and send you alerts ("Robinhood AI trading signals") that you execute manually in the app. Direct API bots for Robinhood are harder for retail investors to access safely.

Yes. Webull offers a more open API than Robinhood. Advanced users can connect platforms like QuantConnect to Webull for automated trading. Always ensure you are using regulated scripts.

Yes, if you stick to regulated platforms. We recommend tools like Composer (SEC-registered) or non-custodial signal bots (Tickeron) to ensure you are using safe AI stock tools USA.