Section 80EEB in the Age of AI: Verifying "Green" Claims for Tax Deductions

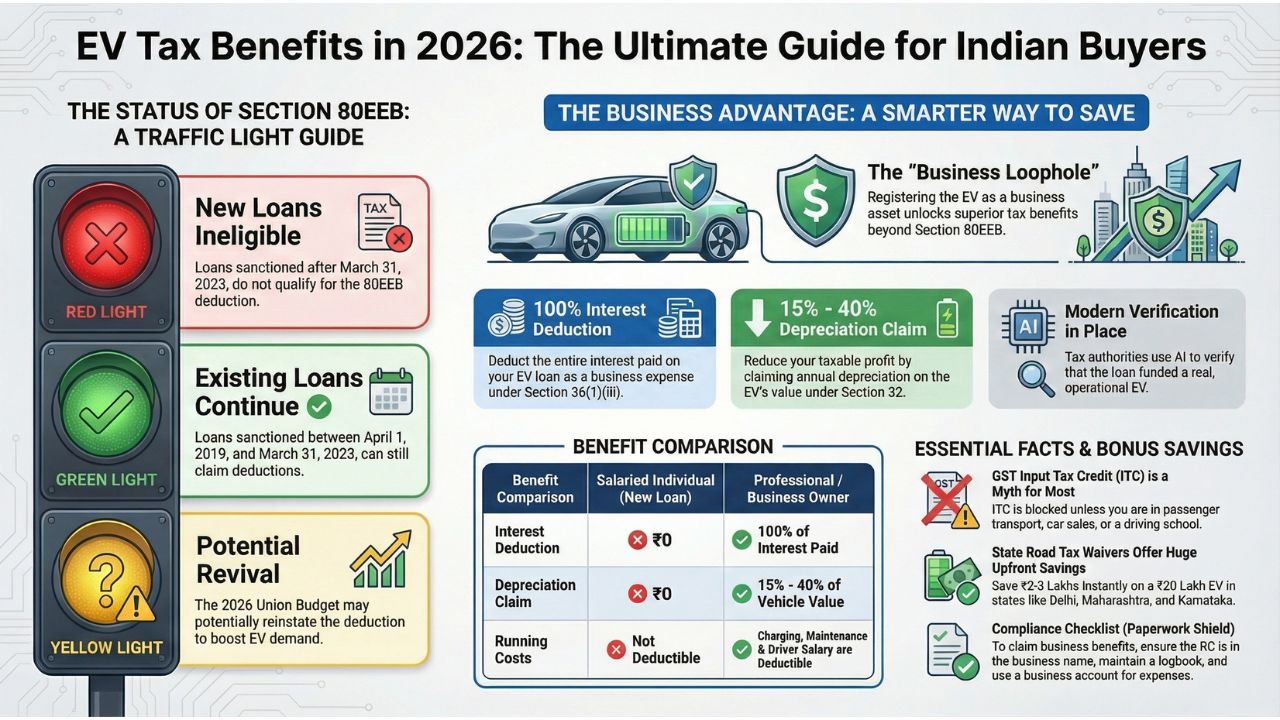

If you've been searching for "Section 80EEB" hoping to save ₹1.5 lakh on your new EV loan interest, here's the reality: the deduction for individuals expired on March 31, 2023, and any loan sanctioned after that date is no longer eligible, unless the government revives it in the 2026 Budget.

But there's good news. If you're a professional, consultant, or business owner, you actually have access to far better tax-saving opportunities that go beyond 80EEB.

Today, the government may love green mobility, but the Income Tax Department loves proof. Banks and auditors now use AI and blockchain-powered verification to ensure your EV loan was genuinely used for an operational electric vehicle. These digital checks prevent compliance errors that could cost you deductions.

In this guide, we break down everything you need to know for FY 2026, from the real status of Section 80EEB to the powerful "business loophole" that can help you save even more money on your EV purchase.

Related Deep Dives on Finance & Tech

1. The Status of 80EEB (The "Traffic Light" System)

Is Section 80EEB still valid for you? Check your loan sanction letter date immediately.

Red Light (New Individual Loans):

Did you get your loan sanctioned after March 31, 2023? Stop. You cannot currently claim the 80EEB deduction limit 2026. The window for new applicants has closed.

Green Light (Old Loans):

Was your loan sanctioned between April 1, 2019, and March 31, 2023? Go ahead. You can continue claiming up to ₹1.5 Lakhs/year until the loan is fully closed.

Yellow Light (The 2026 Budget Watch):

With the FAME-III subsidy uncertainty, analysts predict a return of 80EEB to keep demand alive. Watch the February 2026 Budget closely for updates on Section 80EEB eligibility for loans sanctioned after March 2023.

2. The "Business Loophole": Better Than 80EEB

If you are a consultant, freelancer, Doctor, Architect, Lawyer, Content Creator, or Business Owner, do not register the EV in your personal name. Register it as a Business Asset. This is the secret to buying EV in business name vs personal name.

Benefit A: Unlimited Interest Deduction

Under Section 36(1)(iii), interest paid on capital borrowed for business is 100% deductible as a business expense.

The Math: 80EEB is capped at ₹1.5L. If you pay ₹2.5L interest on a luxury EV (like a BYD Seal), the Business route saves you tax on the entire ₹2.5L. This is how to claim full interest deduction on EV loan.

Benefit B: Depreciation (The "Shield")

Cars are depreciating assets. For a business, depreciation is a non-cash expense that lowers your profit (and thus your tax).

- The Rate: Standard motor cars get 15% depreciation. However, pure EVs often qualify for higher rates (up to 40%) depending on their classification as renewable energy devices.

- The "Commercial" Kicker: If you use the vehicle for "running on hire" (like a fleet), the rate can jump even higher.

Always check the EV depreciation rate with your CA for the current year.

3. Comparative Table: Salaried vs. Professional

See the difference clearly in this EV loan tax benefit calculator table:

| Feature | Salaried Individual (New Loan) | Professional/Business Owner |

|---|---|---|

| Tax Section | None (Currently) | Sec 36(1)(iii) + Sec 32 |

| Interest Deduction | ₹0 | 100% of Interest Paid |

| Depreciation Claim | ₹0 | 15% - 40% of Car Value |

| Driver Salary | Paid from post-tax income | Deductible Business Expense |

| Charging Costs | Paid from post-tax income | Deductible Business Expense |

4. GST Input Tax Credit (ITC): The Myth Buster

Common Myth: "I can claim GST back on the car purchase."

The Fact: No, you usually can't.

According to Section 17(5) of the CGST Act, GST input tax credit on electric vehicles eligibility is "Blocked" for motor vehicles with seating capacity of 13 or less.

The Exceptions: You can only claim ITC if you are in the business of:

- Transporting passengers (e.g., Taxi operators, Uber/Ola drivers).

- Selling cars (Car dealerships).

- Driving schools.

Verdict: For most consultants and business owners, you cannot claim GST credit. The GST becomes part of the car's cost (which you then depreciate).

5. State-Level "Hidden" Subsidies (FY 2026)

While Income Tax is Central, Road Tax is State. This is where you save big upfront. Several states continue to offer 100% Road Tax Waivers for EVs in 2026:

- Maharashtra

- Karnataka

- Delhi

- Tamil Nadu

- Punjab

Calculator: On a ₹20 Lakh petrol car, road tax is ~₹2-3 Lakhs. On a ₹20 Lakh EV in these states, road tax is ₹0. That immediate saving of ₹3 Lakhs is often more valuable than a tax deduction spread over years.

6. Actionable Checklist: The Paperwork Shield

If you are claiming your EV as a business asset, you must be ready to prove "Business Use" to the Income Tax Officer.

- Registration: The RC (Registration Certificate) must be in the name of the Firm or Company, or the Proprietor (matching the Business PAN).

- Books of Accounts: Ensure the vehicle is entered in your Fixed Asset Register.

- Logbook: Maintain a basic log of business trips (client visits, site inspections) to justify the expense.

- Expenses: Pay for charging and maintenance using the Business Bank Account, not your personal UPI.

Frequently Asked Questions (FAQs)

For loans sanctioned between April 1, 2019, and March 31, 2023, the deduction limit is ₹1.5 Lakhs per financial year on the interest paid.

As an individual, you cannot claim 80EEB for new loans sanctioned in 2026 (unless the government reintroduces it). However, business owners can claim depreciation on electric vehicles for business FY 2025-26 and interest deductions under business expense sections.

Generally, no. Input Tax Credit (ITC) is blocked under Section 17(5) for passenger vehicles unless you are in the business of transporting passengers or selling vehicles.

Major states like Delhi, Maharashtra, Karnataka, and Tamil Nadu offer 100% road tax waivers for EVs, significantly reducing the on-road price.

Sources and References

- TaxBuddy: Section 80EEB: Deduction on Electric Vehicle Loan Interest (AY 2025-26)

- Income Tax Department: The Income Tax Act, 1961 as amended by Finance Act, 2025

- Section 36 in The Income Tax Act, 1961

- Sandeep Ahuja & Co: Electric Vehicles Depreciation under the Income Tax Act, 1961

- IDOLSRM: EV Road Tax Policy 2025: State-Wise Exemptions Explained

- Paytm: Section 17(5) of GST: Blocked Input Tax Credit (ITC)

Back to Pillar Page: AI Driven EV and Green Finance in India