The End of Fixed Rates: Why Your EV's Battery Data is Your New Credit Score

It is 2026. You walk into a bank in Bangalore to buy a three-year-old Tata Nexon EV. The car looks pristine, the odometer is low, and the seller is honest. In the old days (2024), the loan officer would have looked at the "manufacturing year," shrugged, and offered you a high interest rate, or rejected the loan entirely.

Why? Because of the "Lemon Problem."

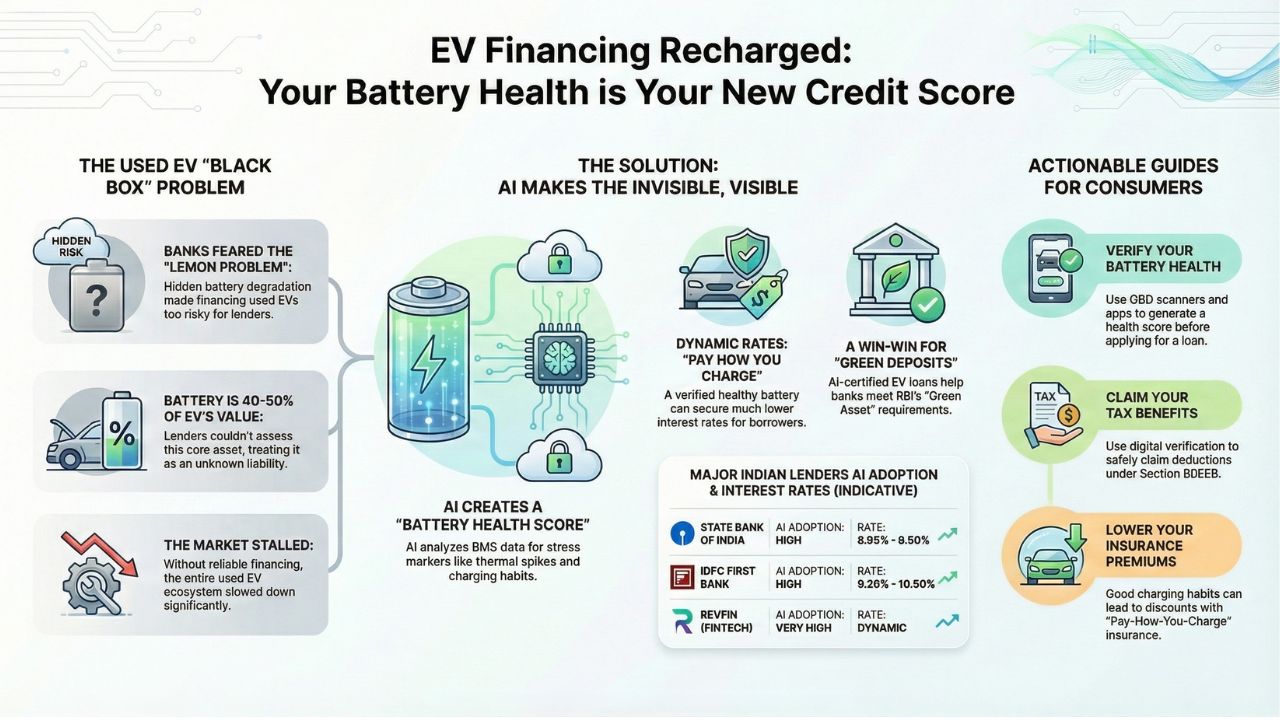

For decades, banks knew how to value a petrol car. But an Electric Vehicle is different. The battery accounts for 40-50% of the vehicle’s value, and until recently, it was a "Black Box." A battery could look new but maybe chemically degraded from years of fast charging in 45°C heat. Banks couldn't see this risk, so they refused to finance used EVs.

This limitation ends today as we inaugurate the era of Algorithm-Driven Finance. In modern India, electric vehicle financing has moved beyond just your salary slip; it now hinges on the condition of the lithium ions housed within the battery pack. AI algorithms are now analyzing Battery Management System (BMS) data to create a "Health Score" that unlocks lower interest rates, instant approvals, and higher resale values.

Here is how Artificial Intelligence is rewriting the rules of green finance India.

The "Black Box" Problem: Why Banks Feared Used EVs

Imagine lending ₹10 Lakhs for an asset that might become worthless in six months. That has been the reality for banks dealing with used EV loan eligibility. Unlike an engine, which gives audible warning signs before failing, a lithium-ion battery degrades silently.

A phenomenon known as "capacity fade" occurs due to chemical changes inside the cells. Without data, a bank assumes the worst-case scenario: that the battery is a "Lemon." This fear paralyzed the secondary market. If you can't get a loan for a used EV, you don't buy one. If you can't sell your old EV, you don't buy a new one. The entire ecosystem stalled, until AI stepped in to make the invisible visible.

How AI Models Predict Decay: The Science Behind the Score

How does a bank know if a battery will last another 5 years? They don't look at the car; they look at the Cloud.

Modern EVs transmit terabytes of data. AI models (specifically LSTM and Transformer networks) analyze this time-series data to perform a granular EV battery degradation cost analysis. These algorithms look for specific "stress markers":

- Thermal Runaway Events: How often did the battery temperature spike above safe limits?

- Voltage Deviation: Are specific cells discharging faster than others (imbalance)?

- Cycle Aging: Has the user frequently charged to 100% and drained to 0% (bad practice), or stayed in the healthy 20%-80% zone?

By processing this data, the AI generates a Resale Confidence Score. This score is the "truth" that AI in EV lending relies on. It tells the lender exactly what the asset is worth, removing the risk premium.

Dynamic Interest Rates: "Pay-How-You-Charge"

This is the biggest shift for the consumer. Just as "telematics" insurance lowers your premium if you drive safely, EV loan interest rates India 2026 are becoming dynamic based on battery care.

If you are buying a used EV with a "Grade A" Battery Health Score (verified by AI), banks see this as a secured, low-risk asset.

- Standard Used Car Rate: 12-14%

- AI-Verified "Healthy Battery" Rate: 9-10%

Furthermore, some forward-thinking lenders are introducing variable EMIs. If you maintain the battery health (by avoiding rapid charging in extreme heat), your interest rate effectively drops. Your charging habits are now part of your financial identity.

The "Green Deposit" Connection

Why are banks suddenly so interested in this? It’s not just about lending; it’s about holding.

Indian banks are launching "Green Deposit" schemes, where they promise depositors that their money will fund eco-friendly projects. To do this, banks need a portfolio of verified green assets. An AI-certified EV loan is a prime "Green Asset." By funding your EV, banks can fulfill their regulatory requirements for green finance India, creating a win-win scenario.

Top 5 AI-Ready Lenders for EV Loans in India (2026)

Who is actually using this tech? While many are still catching up, these institutions are leading the charge in integrating tech-first models into their lending logic.

| Bank / NBFC | AI Adoption Level | Typical Interest Rate (2026)* | Best For |

|---|---|---|---|

| State Bank of India (Green Car Loan) | High (Partnerships) | 8.85% - 9.50% | New EVs & Long Tenure |

| HDFC Bank | Medium (Data Pilot) | 9.00% - 9.75% | Best banks for electric car loans (Premium/Luxury) |

| IDFC First Bank | High (Tech-First) | 9.20% - 10.50% | Used EV Financing |

| RevFin (Fintech) | Very High (AI Native) | Dynamic | How to finance used electric scooter (2-Wheelers) |

| Union Bank of India | Medium | 8.90% - 9.60% | Green Deposit Backed Loans |

*Rates are indicative and subject to battery health scores.

Explore Our "Green Finance" Content Hub

This page is just the beginning. To navigate the complex world of AI-driven finance, explore our specialized guides below.

1. Consumer Guide: Validating Your Asset

This comprehensive guide empowers borrowers to take charge of the valuation process, ensuring they never walk into a bank blind. Instead of waiting for a lender to assess the vehicle, or risking rejection due to the old "Lemon Problem", consumers can now proactively run their own diagnostics to establish the true value of their EV.

The guide details how to use OBD scanners and specialized mobile apps to generate the same technical certificates that banks trust, effectively proving the health of the lithium-ion battery before a loan application is ever submitted.

By validating the "Battery Health Score" yourself, you can confirm you aren't buying a degraded asset and position yourself to secure the lower interest rates reserved for "verified" healthy vehicles

2. Powering Your Life: The PM Surya Ghar Blueprint

Achieving the "Zero Bill" math relies on a strategic combination of government incentives, smart financing, and grid mechanisms. For solar systems above 3kW, homeowners can leverage a flat subsidy of up to ₹78,000, significantly reducing the initial upfront cost. To fund the remainder, major lenders like SBI and Union Bank now offer dedicated "Solar Roof Loans" at repo-linked interest rates of approximately 7%, which is far cheaper than standard personal loans. Furthermore, the implementation of Net Metering transforms your connection into an energy bank; by sending excess power to the grid during the day and drawing it back at night, you effectively manage your consumption through energy credits rather than just currency..

3. The Developer Deep Dive: The Code Behind the Cash

Targeting the architects of the fintech revolution, this section offers a granular look at the specific Machine Learning architectures that make algorithm-driven finance possible. It moves beyond high-level concepts to break down the actual code used to predict battery life, providing a comparative analysis of Long Short-Term Memory (LSTM) networks versus Transformer networks.

The guide explores how these Recurrent Neural Networks and Digital Twins process terabytes of time-series data, searching for stress markers like thermal runaway and voltage deviation, to generate the "Resale Confidence Score" that lenders rely on to price risk.

4. Tax & Policy: Maximizing Your ROI

While AI algorithms verify the quality of the asset, this section focuses on the regulatory framework that makes the investment financially viable through government subsidies. It provides a detailed roadmap for ensuring your "Green" claims can withstand strict scrutiny, which is essential for claiming significant tax breaks under Section 80EEB for the financial year 2026. With banks now under pressure to validate "Green Assets" for their deposit schemes, this guide explains the stricter digital verification standards being implemented to ensure loans are for legitimate, operational EVs, ensuring you don't miss out on deductions due to compliance errors.

5. Insurance Trends: The Next Frontier

This guide examines the rapid evolution of AI from a tool for simple loan origination to a mechanism for real-time asset protection and risk management. It highlights the industry shift from traditional "Pay-As-You-Drive" models to the new, battery-centric "Pay-How-You-Charge" paradigm, where premiums are dynamically adjusted based on charging habits.

By leveraging telematics, insurers can now monitor specific behaviors, such as avoiding rapid charging in extreme heat, offering lower costs to owners who actively maintain their battery's health and reduce the risk of capacity fade

Frequently Asked Questions (FAQ)

Generally, EV loan interest rates India 2026 are 50-100 basis points lower than ICE (Internal Combustion Engine) loans, specifically because of the "Green Finance" incentives offered by the RBI and specific bank schemes.

Yes, but it is harder than for cars. Traditional banks are hesitant, but AI-driven Fintechs like RevFin use psychometric and battery data to determine how to finance used electric scooter purchases.

Beyond your credit score, the "State of Health" (SoH) of the battery is critical. Battery health affecting resale value is the primary metric lenders use to determine the loan-to-value (LTV) ratio.

Yes, Section 80EEB allows for deductions on interest paid. However, stricter digital verification is being implemented to ensure the loan is for a legitimate, operational EV.