How AI and Telematics Cut Your EV Insurance Cost in India

For years, car insurance followed a simple rule: pay a fixed premium based on your age, location, and accident history.

But the Electric Vehicle (EV) revolution, powered by Artificial Intelligence (AI) and real-time monitoring, is changing everything.

Forget simply searching for the cheapest EV insurance cost India; the new goal is to earn the lowest possible premium through smart driving and charging habits.

This guide breaks down the exciting shift from traditional 'Pay-As-You-Drive' to the new, battery-centric 'Pay-How-You-Charge' model, and how you can benefit from lower electric car insurance cost right now.

Related Deep Dives on AI & EV Finance

1. The Power of Telematics: From ‘Where’ to ‘How’

Telematics is the fusion of telecommunications and informatics, using sensors and GPS within your EV to collect real-time data.

This data is transmitted to the insurer, allowing them to assess your risk profile with incredible accuracy.

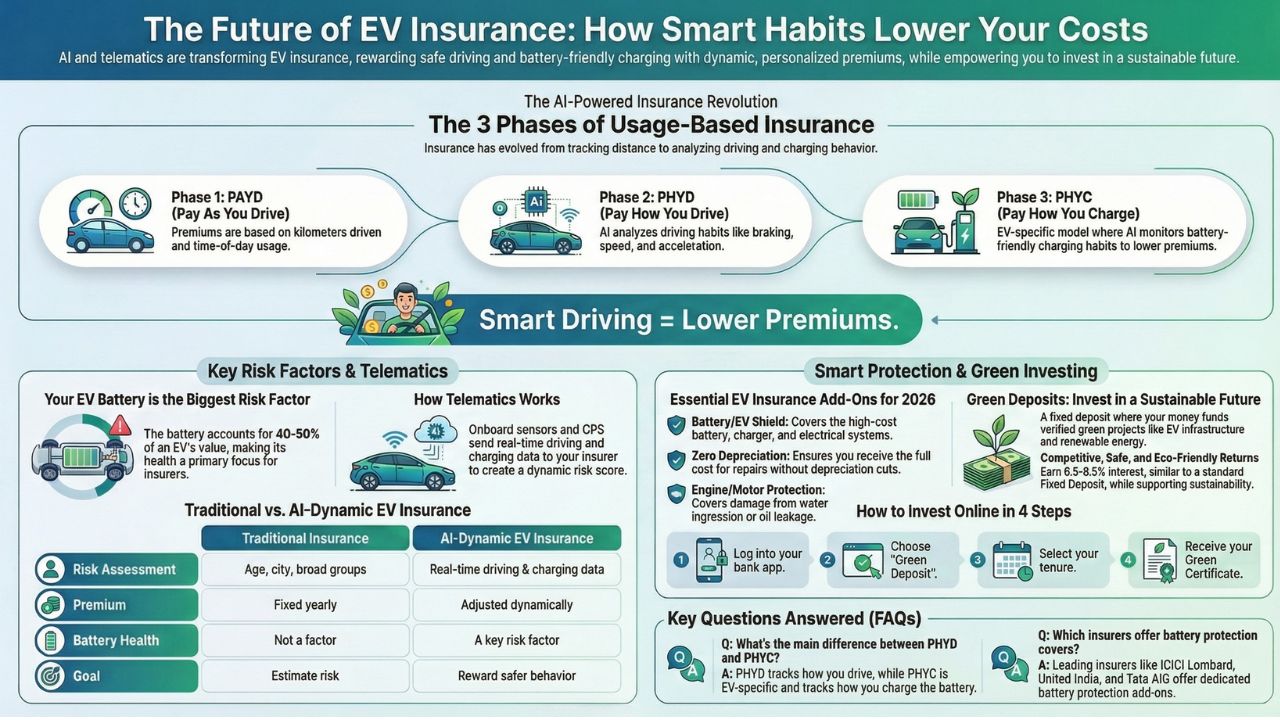

The Evolution: PAYD to PHYD

Phase 1: Pay-As-You-Drive (PAYD)

This was the first step in usage-based insurance India. It monitored simple metrics like mileage and the time of day you drove, rewarding infrequent drivers with lower costs. This model works, with some companies offering a pay as you drive insurance EV cover with kilometer caps (e.g., 10,000 km).

Phase 2: Pay-How-You-Drive (PHYD)

This model, common in current telematics insurance India, uses AI to monitor how you drive. It tracks behaviors like harsh braking, sudden acceleration, and speeding. Safer drivers, who avoid late-night or risky routes, can receive significant discounts.

Phase 3: Pay-How-You-Charge (PHYC)

This is the AI insurance frontier for electric vehicles. Since the battery pack can account for 40-50% of the EV's total value, its health is the biggest risk factor for insurers. The PHYC paradigm is a new, battery-centric model where your premiums are dynamically adjusted based on your charging habits.

The AI Angle: AI doesn't just track speed; it analyzes how you treat your battery. Avoiding habits like frequent 100% fast charging, especially in extreme heat, or letting the charge drop too low, is considered "battery-friendly" behavior. Insurance discounts for battery-friendly drivers are offered to those who actively maintain their battery's health and reduce the risk of capacity fade.

2. Dynamic Premiums: The New EV Insurance Cost India

Dynamic pricing is a real-time, data-driven strategy that adjusts your premium based on your individual risk profile. For EVs, this means your electric car insurance premium calculator is constantly running in the background.

| Risk Factor | Traditional Insurance | Dynamic (AI) Insurance |

|---|---|---|

| Risk Assessment | Based on broad categories (age, city) | Based on real-time driving & charging habits |

| Premium Adjustment | Fixed, adjusted annually at renewal | Dynamically adjusted dynamically, offering continuous rewards |

| Battery Health | Not considered directly | AI monitors EV battery health and charging habits to adjust risk score |

| Goal | Assess financial risk | Encourage positive, safer behavior (reduce claims) |

How AI reduces EV insurance premiums: AI algorithms assess your driving smoothness, charging regularity, and vehicle health data to assign a "dynamic hazard score". A safer score immediately translates to a lower EV insurance premium, creating a virtuous cycle where better behavior saves you money.

3. Beyond the Base Policy: Add-Ons You Need

While major players like Tata AIG EV insurance, ICICI Lombard, HDFC ERGO, and Digit offer the best insurance for electric vehicles India, the real protection comes from smart add-ons:

- Battery Replacement Insurance Coverage (EV Shield): This is the most crucial cover for an EV. Given that the battery is the most expensive component, an add-on like the "EV Shield" specifically covers loss or damage to the electrical panel, vehicle charger (including the cable), and offers roadside assistance related to the battery.

- Zero Depreciation (Bumper-to-Bumper): This add-on is highly recommended, especially for new EVs, as it ensures you get the full cost of repairs/replacements without depreciation cuts (excluding tyres and batteries in some cases).

- Engine Protection: Covers damage to the motor/engine due to oil leakage or water ingression, a vital cover in flood-prone cities.

4. Green Deposits: A New Eco-Friendly Investment

As the finance industry becomes greener, you can now align your savings with your values. A Green Deposit is similar to a standard Fixed Deposit (FD), but the capital you invest is exclusively channeled by the bank into environmentally friendly projects.

These projects include electric vehicle infrastructure, renewable energy (solar, wind), and clean transportation.

Benefit: You earn competitive FD interest rates (often 6.5% to 8.5% in India), while your money actively supports climate mitigation efforts, giving you ethical satisfaction and portfolio diversification.

Regulation: The RBI has established a framework for banks to issue green deposits, with strict rules preventing "greenwashing" and mandating third-party verification on how the funds are used.

How to Invest (Digital Process)?

You rarely need to visit a branch in 2026.

- Net Banking: Log in to your bank app (YONO, FedMobile, etc.).

- Select Scheme: Look under the "Deposits" section for "Green Deposit" or "Special Term Deposit."

- Choose Tenure: Many green deposits have specific tenures (like 1,111 days) to match the loan cycles of infrastructure projects.

- Certificate: Once funded, you can often download a "Green Certificate" acknowledging your contribution to the planet.

Conclusion

In the end, both Green Deposits and AI-driven EV insurance show how consumers now have the power to shape a cleaner, smarter financial future.

When you choose sustainable products whether by parking your savings in Green Deposits or adopting “Pay-How-You-Charge” insurance, you’re not just benefiting your own wallet. You’re sending a clear signal that responsible choices matter. Thoughtful saving and thoughtful driving now directly translate into real-world impact: a healthier planet, fairer pricing, and a financial system that rewards sustainability instead of punishing it.

Frequently Asked Questions (FAQs)

EV insurance premiums are generally higher because the battery system is the single most expensive component, accounting for up to 60% of the vehicle's cost. This leads to higher Insured Declared Value (IDV) and, consequently, higher potential replacement costs for the insurer.

PHYD rewards safe driving behaviors like smooth braking, gentle acceleration, and avoiding high speeds, using telematics. PHYC is an evolution specific to EVs where AI monitors how you treat the battery (e.g., avoiding frequent fast charging) to offer dynamic insurance premiums based on battery health.

Many leading insurers now offer dedicated battery protection covers. For instance, ICICI Lombard and United India have "Battery Protect" add-ons, while Tata AIG EV insurance offers an "Electric Surge" add-on that covers damage to the EV and its charging equipment.

A Green Deposit is a special type of Fixed Deposit where the bank guarantees that your funds will be used only for financing approved eco-friendly projects (like EV infrastructure or renewable energy). It is as safe as a regular FD, being covered by DICGC insurance up to ₹5 lakhs per depositor.

Sources and References

- EV Insurance in India 2025: 16x Growth, AI-Powered Plans & FASTag-Linked Charging

- Team-BHP: 2025: Your Preferred EV Insurance Company - Team-BHP

- V3Cars: The Future Of EV Insurance In India – Key Trends To Watch

- Policybazaar: Electric Car Insurance: EV Insurance for Electric Vehicle

- Upstox: What is Green Deposit? Meaning, Features, Benefits & How It Works