How to Check Your EV Battery Health Before Loan Approval?

Imagine you are about to buy a used Tata Nexon EV. It looks shiny, has low kilometers, and the seller swears it is perfect. But how do you know if the battery inside is actually healthy? In the past, you had to guess. Today, you don't have to.

In the world of Used EVs (Electric Vehicles), your CIBIL score is only half the story. The other half? The Battery Health Score. Buying a used Electric Vehicle (EV) without checking the battery is like buying a house without checking the foundation.

The battery is 40-50% of the car's value. If it is weak, you lose money. But if it is strong, you can actually get a cheaper loan from the bank! Here is your simple, step-by-step guide on how to check EV battery health and prove it to the bank to save money.

Related Deep Dives on AI Driven EV Finance

Why You Can't Trust the Odometer Anymore

For decades, valuing a used petrol car was easy. A 3-year-old Swift Dzire has a predictable market value. But a 3-year-old Tata Nexon EV? That was a mystery.

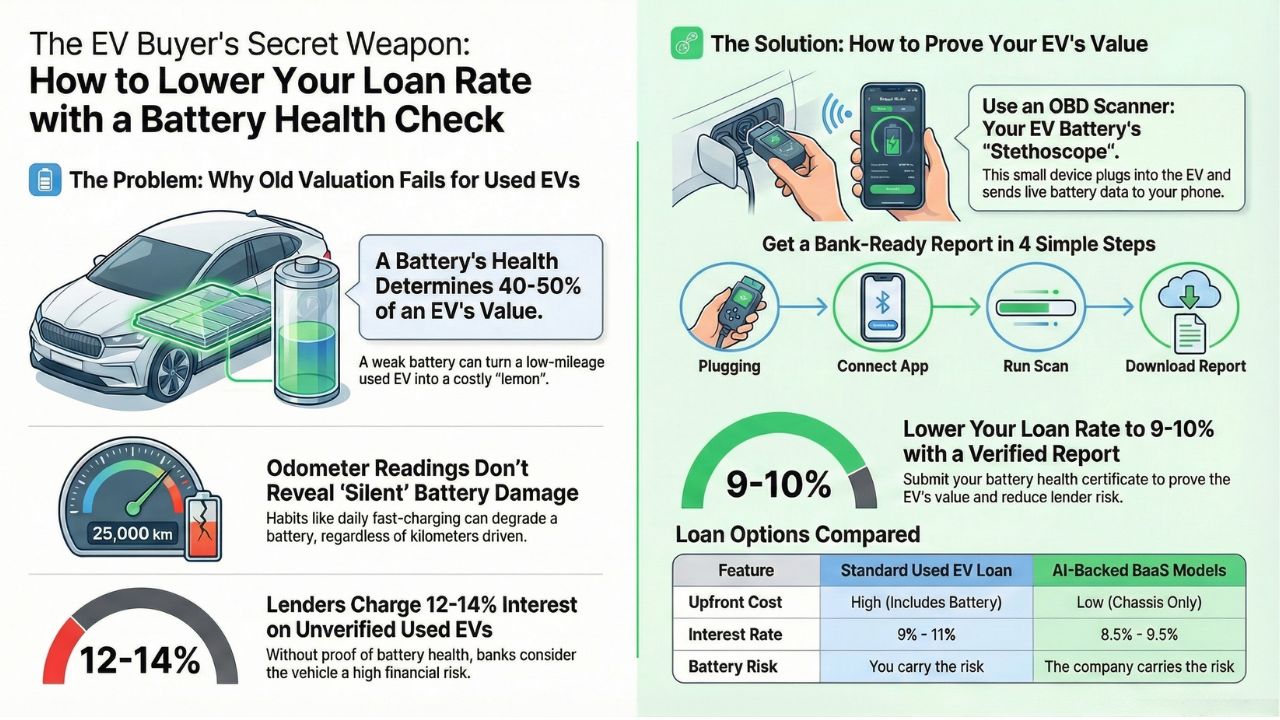

In petrol cars, the odometer (kilometers driven) told you everything. In EVs, it is different. A battery degrades "silently". A car might have low mileage, but if the previous owner fast-charged it every day in 45°C heat, the battery could be damaged inside. This is called "capacity fade".

The battery makes up nearly 40–50% of an EV’s total cost, which means even a small amount of damage can drastically reduce the vehicle’s value. If the previous owner fast-charged the car daily or regularly charged it to 100%, the battery may already be degraded, turning the vehicle into a potential "lemon."

Because banks had no visibility into true battery health, they considered used EVs extremely risky. As a result, they either charged very high interest rates (12–14%) or offered very low Loan-to-Value ratios, sometimes funding only half the vehicle’s price.

But now, you can use technology to see inside the battery. This is how to avoid buying a used EV with a degraded battery.

The Magic Tool: What is an OBD Scanner?

Enter the new wave of battery intelligence. Startups and tech providers have developed tools that plug into the EV’s OBD (On-Board Diagnostics) port and read the internal chemistry of the battery cells. To perform a DIY EV battery diagnostic test for bank financing, you need a small tool called an OBD Scanner.

Think of an OBD scanner for electric cars India like a doctor’s stethoscope.

- What it is: A small device that plugs into a port under your car’s dashboard (usually near the steering wheel).

- What it does: It talks to the Battery Management System (BMS) and sends data to your phone via Bluetooth.

You don't need to be a mechanic to use a Bluetooth OBD2 scanner for EV. You just need the scanner and the best EV battery health app on your phone.

Step-by-Step Guide to Verify Lithium-Ion EV Battery

Here is exactly how you can run your own diagnostics to establish the true value of your EV.

- Plug in the Scanner: Insert the OBD tool into the port of the used EV you want to buy.

- Connect the App: Open your predictive analytics app and pair it via Bluetooth.

- Run the Scan: The app will read the historical data. It checks for "stress markers" like how often the battery got too hot (Thermal Runaway) or if it was charged too often to 100%.

- Get the Score: The app generates a "Health Report." This is your golden ticket.

Three AI Tools That Certify Used EV Battery Health for Indian Lenders

You need tools to measure EV battery degradation that banks actually trust. Simple voltage readers aren't enough. You need AI-powered apps that provide an EV battery health certificate. Here are three types of tools leading the market:

1. The "Deep Dive" Scanner Apps (Consumer Focused)

These are the best OBD scanner for EV battery testing at home. They connect to popular cars like the Tata Nexon or MG ZS EV. They analyze cell voltages to see if any specific cells are discharging faster than others (imbalance).

Best for: The first check before you even talk to the seller about price.

2. The "Resale Certificate" Platforms

These apps are designed for testing electric scooter battery health and car batteries specifically for resale. They use AI to predict how long the battery will last in the future. They give you a printable battery report for used car loan applications.

Best for: Negotiating the price with the seller.

3. The "Bank-Ready" API Tools

Some advanced apps link directly to how banks evaluate EV battery data for loan eligibility. They generate a "Resale Confidence Score". This score tells the lender exactly what the asset is worth, removing their fear of risk.

Best for: Submitting to the bank to get a lower interest rate.

How to Prove EV Battery Health to Get Better Loan Rates

This is the most important part. Once you have your EV battery health score for low-interest loan approval, you can demand a better deal. Banks in India are now moving to "Algorithm-Driven Finance". They offer lower rates for "Green Assets" that are verified.

- Standard Used Car Rate: 12-14%.

- Your Rate (with Healthy Battery Certificate): 9-10%.

Comparison Table: Buying vs. Subscribing (2026 Estimates)

| Feature | Standard Used EV Loan | AI-Backed BaaS (e.g., Vidyut) |

|---|---|---|

| Upfront Cost | High (Includes Battery) | Low (Chassis Only) |

| Interest Rate | 9% - 11% (Risk on Battery) | 8.5% - 9.5% (Asset is safer) |

| Battery Risk | You own the risk. | Company owns the risk. |

| Resale Value | Depends on Battery Health | Guaranteed Resale Value |

| Best For | Heavy usage (>50km/day) | Low/Medium usage or Fleet |

Here is your action plan:

- Don't wait for the bank. Banks might assume the worst if you don't have data.

- Generate the report. Use your mobile apps to generate EV battery health certificate.

- Submit it with your loan application. Show them the "State of Health" (SoH) and the "Resale Confidence Score".

Conclusion: Be Smart, Buy Green

This consumer guide to EV battery valuation and resale value is your secret weapon. By taking charge of the valuation process, you ensure you never walk into a bank blind. You are not just buying a car; you are investing in technology. Make sure that technology is healthy. So, check used EV battery life before buying, get that certificate, and enjoy the drive with a lower EMI!

Frequently Asked Questions (FAQ)

Generally, interest rates for Electric Vehicle loans are 50-100 basis points lower than those for Internal Combustion Engine (ICE) vehicles. This discount is driven by specific "Green Finance" incentives offered by the RBI and various bank schemes designed to promote eco-friendly adoption.

Yes, but it is traditionally harder than getting a loan for a car. However, specialized AI-driven Fintech companies (like RevFin) are now using psychometric data and battery health data to approve finance for used electric scooters, filling the gap left by traditional banks.

Beyond your personal credit score, the single most critical factor is the "State of Health" (SoH) of the battery. Lenders use this metric to determine the Loan-to-Value (LTV) ratio because battery health directly dictates the vehicle's resale value.

Yes. Section 80EEB allows for deductions on the interest paid on EV loans. However, banks are implementing stricter digital verification to ensure these loans are used for legitimate, operational EVs before certifying them for these tax breaks.

Sources and References

Back to AI Driven EV Finance in India: A Comprehensive Guide