Powering Your Life: The PM Surya Ghar Blueprint for Zero Bills

If you own a roof in India and it’s just sitting there empty, you are losing money every single day. The sun is shining, but your electricity meter is still spinning fast. The PM Surya Ghar Yojana (also known as the Muft Bijli Yojana) has changed the game. It is now easier than ever to turn your roof into a power plant.

However, many people get stuck on the money part. How do you pay for it? How do you get the money back? This guide acts as your simple blueprint to Rooftop Solar India, covering everything from the Solar Subsidy India offers to the loan options that make it affordable.

Related Deep Dives on Finance & Tech

The "Zero Bill" Math: How It Works

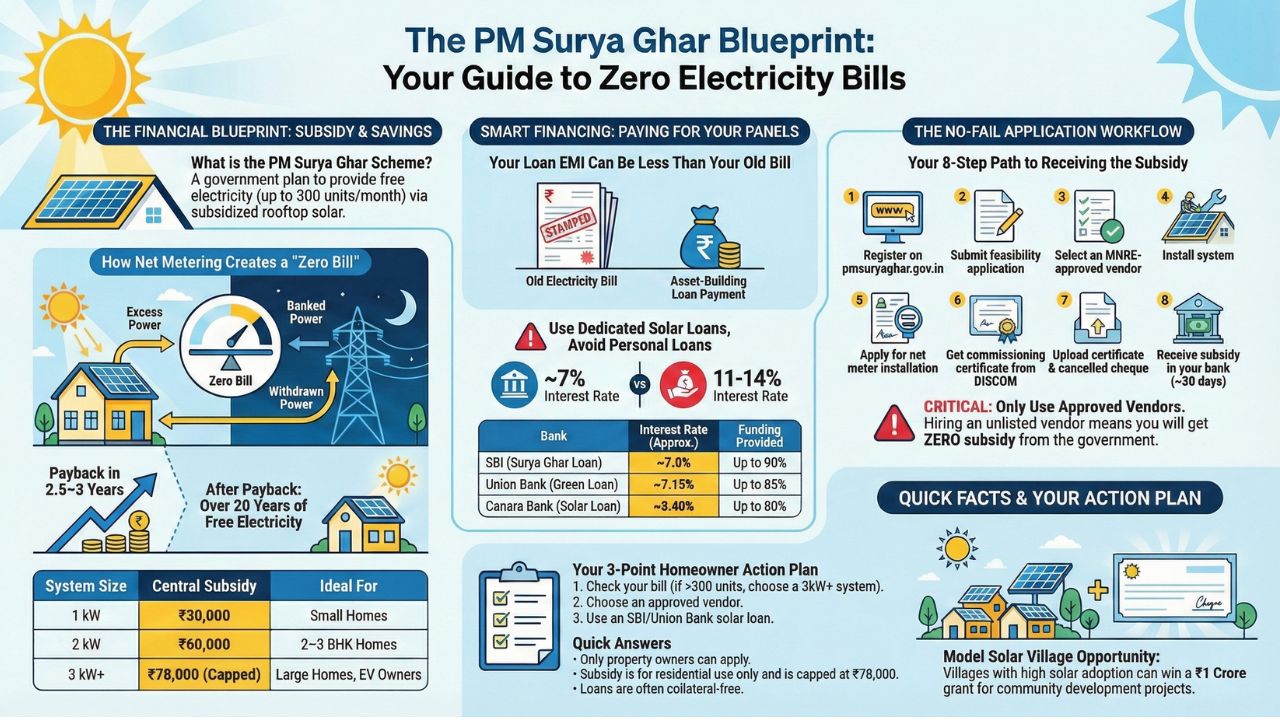

The goal of this scheme is a Zero Electricity Bill. But does the math actually work? Let’s look at the numbers for 2025.

The Big Discount (Subsidy)

The government gives you free money to help buy the panels. For a system above 3kW, you get a flat subsidy of ₹78,000. This money comes directly into your bank account after installation.

Free Electricity

The scheme is designed to give you up to 300 units of free electricity every month. For most Indian homes, this covers lights, fans, TV, and even some AC usage.

| System Capacity | Central Subsidy (Fixed) | Ideal For |

|---|---|---|

| 1 kW | ₹30,000 | Small homes, minimal usage |

| 2 kW | ₹60,000 | 2-3 BHK apartments |

| 3 kW and above | ₹78,000 (Capped) | Large homes, EV owners |

Simple Math: If your bill is usually ₹3,000, and you generate your own power, your new bill could be ₹0 (plus a small fixed meter charge). That is a saving of ₹36,000 every year!

Smart Financing: Solar Roof Loans

You might be thinking, "I don't have ₹2 Lakhs to buy panels right now." You don't need it. Solar Financing India has improved drastically. Banks are now treating solar panels like home loans, not expensive personal loans.

Do not take a Personal Loan for solar. Personal loans charge 11-14% interest. Public Sector Banks (PSBs) offer specific Solar Roof Loans mandated by the scheme, pegged to the Repo Rate.

- Solar Roof Loan Interest Rates SBI: The State Bank of India (SBI) offers dedicated loans with interest rates as low as 7%. This is much cheaper than a personal loan (which is often 12-14%).

- Union Bank Solar Loan Eligibility: Union Bank also offers "Green Loans" with easy paperwork. As long as you own the roof and have an electricity bill in your name, you are likely eligible.

Top Loan Options (2026 Estimates)

| Bank | Product Name | Interest Rate* | Max Loan | LTV (Funding) |

|---|---|---|---|---|

| SBI | Surya Ghar Loan | ~7.00% | ₹6 Lakhs | 90% of Cost |

| Union Bank | Union Green Miles (Solar) | ~7.15% | ₹10 Lakhs | 85% of Cost |

| Canara Bank | Solar Loan | ~8.40% | ₹10 Lakhs | 80% of Cost |

| Private Banks | (HDFC/ICICI) | 10.5% - 12% | Unsecured | 100% |

*Rates are floating and subject to CIBIL scores. Recommendation: Go with SBI or Union Bank. The process is now digital and integrated with the National Portal.

This means your monthly loan EMI might be less than what you used to pay for your electricity bill. You stop paying the electricity company and start paying yourself!

Net Metering: Your Personal Energy Bank

This is the most important part of the system. Net Metering India turns the electricity grid into your personal bank account.

- Daytime: You are at work or school. Your solar panels are making lots of power, but no one is home to use it. This extra power goes to the government grid. You earn Solar Power Banking Energy Credits.

- Nighttime: The sun goes down, and you turn on the lights. You pull power back from the grid.

- The Magic: You don't pay for what you pull back at night because you already "deposited" it during the day. You only pay if you use more than you made.

Quick Guide: Confused by the Portal or Rules?

Many people get confused between the website and the local power company. Here is the PM Surya Ghar Muft Bijli Yojana subsidy details simplified:

- National Portal: You must register on the PM Surya Ghar Portal (pmsuryaghar.gov.in). This is where you apply for the subsidy.

- Local DISCOM: Your local electricity company (DISCOM) is the one that will come to your house to install the Net Meter.

Common Confusion: "Can I calculate my exact savings?" Yes. You can use a tool to calculate solar subsidy India 2025 based on your roof area. The rules for Net Metering rules for home solar can change slightly depending on your state, but the basic principle of "banking energy" remains the same across India.

Step-by-Step: How to Apply

The government has centralized everything on the National Portal for Rooftop Solar. Here is the "No-Fail" workflow:

- Register: Go to pmsuryaghar.gov.in. You need your Electricity Consumer Number, Mobile Number, and Email.

- Feasibility: Apply for a feasibility check. The DISCOM verifies if the local transformer can handle your solar load.

- Vendor Selection (CRITICAL): Once approved, you must select a vendor listed on the portal. Warning: If you hire a private, unlisted local electrician, you will get ZERO subsidy.

- Installation: The vendor installs the plant.

- Net Metering: Apply for the net meter. DISCOM officials will visit to install the bi-directional meter.

- Commissioning: The DISCOM issues a "Commissioning Certificate."

- The Money Shot: Upload the certificate and your cancelled cheque to the portal. The subsidy is credited directly to your bank account within 30 days.

Benefits of grid connected solar system are clear: You save money, you help the planet, and you increase the value of your home.

The "Model Solar Village" Opportunity

Living in a semi-urban or rural area? The scheme includes a competition component. Villages that achieve high solar penetration can be declared a "Model Solar Village", winning a ₹1 Crore grant for community development.

Action: If you are a community leader or RWA member, organizing a bulk purchase for your village/society not only lowers installation costs but could win funding for better roads or lighting.

ROI Calculator: Is it Worth It?

After 3 years, your electricity is effectively free for the next 20+ years (panels usually last 25 years). It is one of the best risk-free investments available in India today.

Next Steps for You

Don't wait for summer to get hotter. Check your latest electricity bill today and see how many units you consume. If it's over 300 units, a 3kW system is your perfect match.

Frequently Asked Questions (FAQs)

No. The subsidy is only for property owners. However, you can seek permission from your landlord, but the electricity connection and the subsidy application must be in the name of the electricity bill holder.

No, the Central Financial Assistance (CFA) of ₹78,000 is exclusively for the Residential Sector. Commercial and Industrial sectors are not eligible for this specific capital subsidy, though they can claim accelerated depreciation (40%) tax benefits.

You can install any capacity your roof allows (e.g., 5kW or 10kW), but the subsidy amount is capped at the 3kW level (₹78,000 maximum). You will pay the full market price for the capacity beyond 3kW.

According to the official timeline, the subsidy is released within 30 days after the Commissioning Certificate is issued and you have submitted your bank details on the portal.

Yes, most PSBs like SBI and Union Bank offer these loans as "Collateral-Free" for amounts up to ₹10 Lakhs (varies by bank policy), as the solar asset itself is hypothecated to the bank.

Sources and References

Back to Pillar Page: AI Driven EV and Green Finance in India