Do You Need Business Insurance for an AI Agency?

AI makes mistakes. The big question is: can your bank account survive them?

If you are following the "AI Solopreneur" model, you are likely operating a high-efficiency enterprise with the output of a 50-person team but the overhead of one. You are using tools that generate text, write code, or create images automatically.

But what happens if your AI chatbot gives a customer dangerous advice? What happens if your automated agent accidentally exposes a client's private database to the public web?

In the traditional world, if you spill coffee on a client's laptop, insurance pays for it. In the AI world, risks are invisible but expensive. If your code "hallucinates," you could be sued for damages.

This critical guide explains why standard liability insurance isn't enough and how to protect your "Zero-Employee Enterprise" from the unique risks of artificial intelligence.

Explore the AI Solopreneur Hub

- The AI Solopreneur: Guide to One-Person Enterprise

- Top 10 AI Agents That Replace Marketing Agencies in 2026

- Best AI CRM Tools for Solopreneurs: Salesforce vs. HubSpot AI

- AI Chatbots vs. Virtual Assistants: The Support Battle

- AI Bookkeeping: Automate Your Business Taxes

- Best Business Credit Cards for AI Startups

- Using Predictive AI for Stock Market Analysis

- Cybersecurity for Solopreneurs: Protecting Data from Deepfakes

- Cloud Hosting for AI: GPU vs. CPU Servers

- How to Build a $10k/Month Business with $0 Upfront Cost

- Case Study: I Let AI Run My Dropshipping Store for 30 Days

- The Death of 9-5: Agentic AI & The Solopreneur Boom

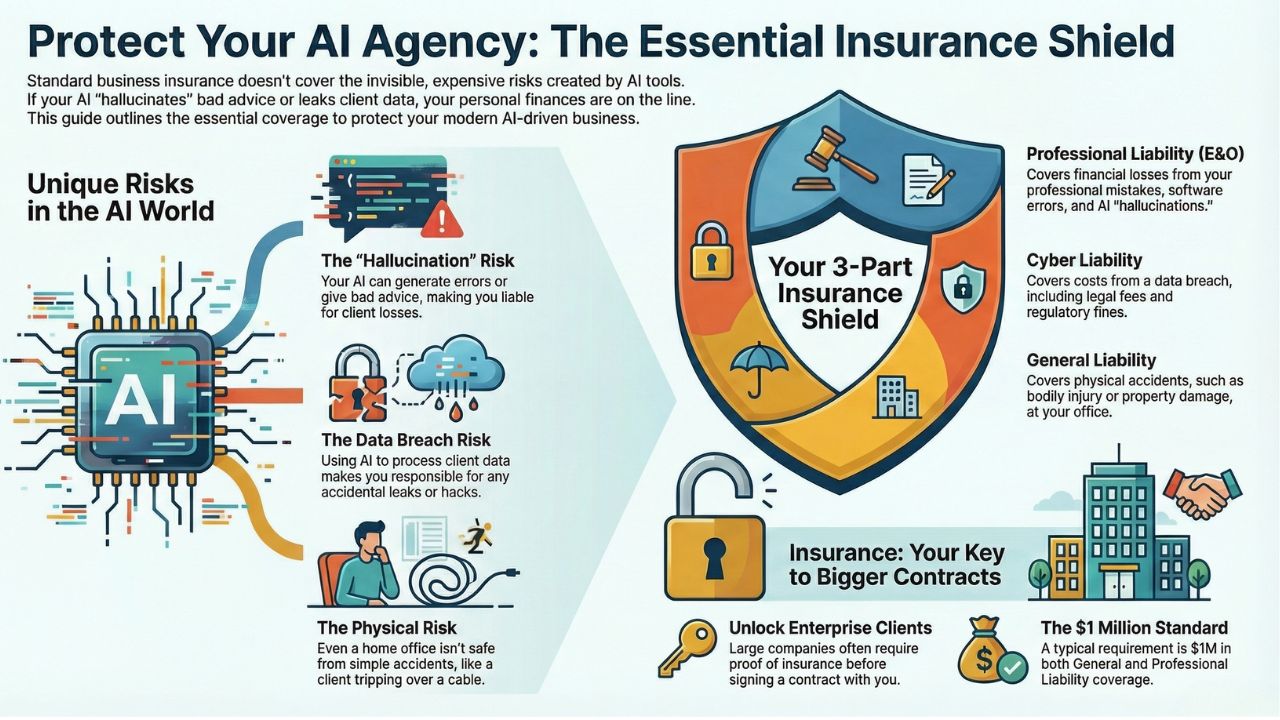

1. The "Hallucination" Risk: Professional Liability

Standard business insurance covers physical accidents. It does not cover "bad advice" or "software failures." Imagine this scenario: You build a customer support chatbot for a client. The chatbot "hallucinates" and promises a customer a 90% discount that doesn't exist. The client loses thousands of dollars and sues you to recover the loss.

This is where professional liability insurance for technology consultants (also known as Errors & Omissions or E&O) is essential.

What it covers

Claims of negligence, mistakes, failure to deliver promised services, and software errors.

Why AI Agencies need it

You cannot manually check every single token your AI generates. If the AI messes up, you are the one responsible.

Action Step

You can easily find errors and omissions insurance quotes online. It is often much cheaper than you think, usually costing less than your monthly coffee budget to protect you from a $100,000 lawsuit.

2. The Data Risk: Cyber Liability

As an AI Solopreneur, you are not just a business owner; you are a data processor. You are feeding emails, customer names, and perhaps financial data into Large Language Models (LLMs). If hackers breach your system or if an AI tool inadvertently leaks data, you are on the hook.

Current cyber liability insurance cost 2025 projections suggest that while premiums are stabilizing, the coverage is becoming vital for small businesses.

What it covers

Legal fees for defense, the cost of notifying customers that they were hacked, and regulatory fines.

The Reality

Standard General Liability policies almost never cover data breaches. You need a specific "Cyber" add-on.

3. The Physical Risk: General Liability

Many AI founders work from home or co-working spaces. It is easy to think, "I don't have a factory, so I don't need insurance." This is a mistake.

General liability insurance for home based business covers the basics: bodily injury and property damage.

Scenario

A client visits your home office to discuss a new AI project. They trip over a server cable and break their ankle.

Coverage

General Liability pays for their medical bills so you don't have to pay out of your personal savings. It also covers you if you accidentally damage a client's property while visiting their office.

4. Contractual Requirements: Getting Paid

Here is a secret: Big clients often won't hire you without insurance. When you start pitching to larger enterprises, their legal departments will send you a vendor contract. That contract will almost always list specific commercial insurance requirements for software companies.

They will typically ask for:

- $1 Million in General Liability.

- $1 Million in Professional Liability (E&O).

If you don't have this, you don't get the contract. Having insurance signals to your clients that you are a "real" business, not just a hobbyist.

5. Finding the Right Provider: Broker vs. Online

Navigating the market can be confusing. When you are ready to buy, you generally have two paths:

Option A: The Digital Route (Fastest)

Use modern insurtech platforms to compare the best small business insurance companies.

Pros: Instant quotes, fully online, lower fees.

Best for: Solopreneurs with standard business models (e.g., marketing agencies, web dev).

Option B: The Human Route (Most Custom)

If your AI business is doing something very high-risk (like medical AI or financial trading bots), an algorithm might reject you. In this case, searching for a business insurance broker near me is the smart move.

Pros: A human expert can explain your specific AI risks to the insurance carriers to get you covered.

Best for: Complex, high-revenue, or niche AI startups.

Frequently Asked Questions (FAQs)

It depends. The government might not require it for a solopreneur, but your clients likely will. Furthermore, if you rent an office, your landlord will 100% require General Liability insurance.

Usually, no. Most homeowner policies specifically exclude business activities. If your laptop is stolen and it's used for business, your home insurance might deny the claim. You need a separate business policy.

General Liability covers physical accidents (slips, falls, broken windows). Professional Liability covers mental/service mistakes (bad code, wrong advice, breach of contract).