Using Predictive AI for Stock Market Analysis

You’ve automated your marketing and your taxes. Now, what do you do with the profit?

In the traditional "9-5" world, you might park your savings in a low-interest account. But for the AI Solopreneur, cash flow is fuel. The goal isn't just to make money; it's to make your money work for you using the same intelligence that runs your business.

This guide demystifies predictive analytics tools for finance and explains how to turn business profits into passive wealth without becoming a Wall Street expert.

Explore the AI Solopreneur Hub

- The AI Solopreneur: Guide to One-Person Enterprise

- Top 10 AI Agents That Replace Marketing Agencies in 2026

- Best AI CRM Tools for Solopreneurs: Salesforce vs. HubSpot AI

- AI Chatbots vs. Virtual Assistants: The Support Battle

- AI Bookkeeping: Automate Your Business Taxes

- Best Business Credit Cards for AI Startups

- Cybersecurity for Solopreneurs: Protecting Data from Deepfakes

- Cloud Hosting for AI: GPU vs. CPU Servers

- Do You Need Business Insurance for an AI Agency?

- How to Build a $10k/Month Business with $0 Upfront Cost

- Case Study: I Let AI Run My Dropshipping Store for 30 Days

- The Death of 9-5: Agentic AI & The Solopreneur Boom

From Passive Saving to Active Intelligence

Most small business owners let their surplus cash sit idle. In 2025, that is a wasted opportunity. AI has democratized financial forecasting. You no longer need a degree in finance to access artificial intelligence investment algorithms.

These tools analyze millions of data points, news headlines, earnings reports, and market trends to predict where the market is going, not just where it has been. This is the next step in the "Money Layer" of your Zero-Employee Enterprise: moving from simple bookkeeping to automated cash flow management tools that grow your capital.

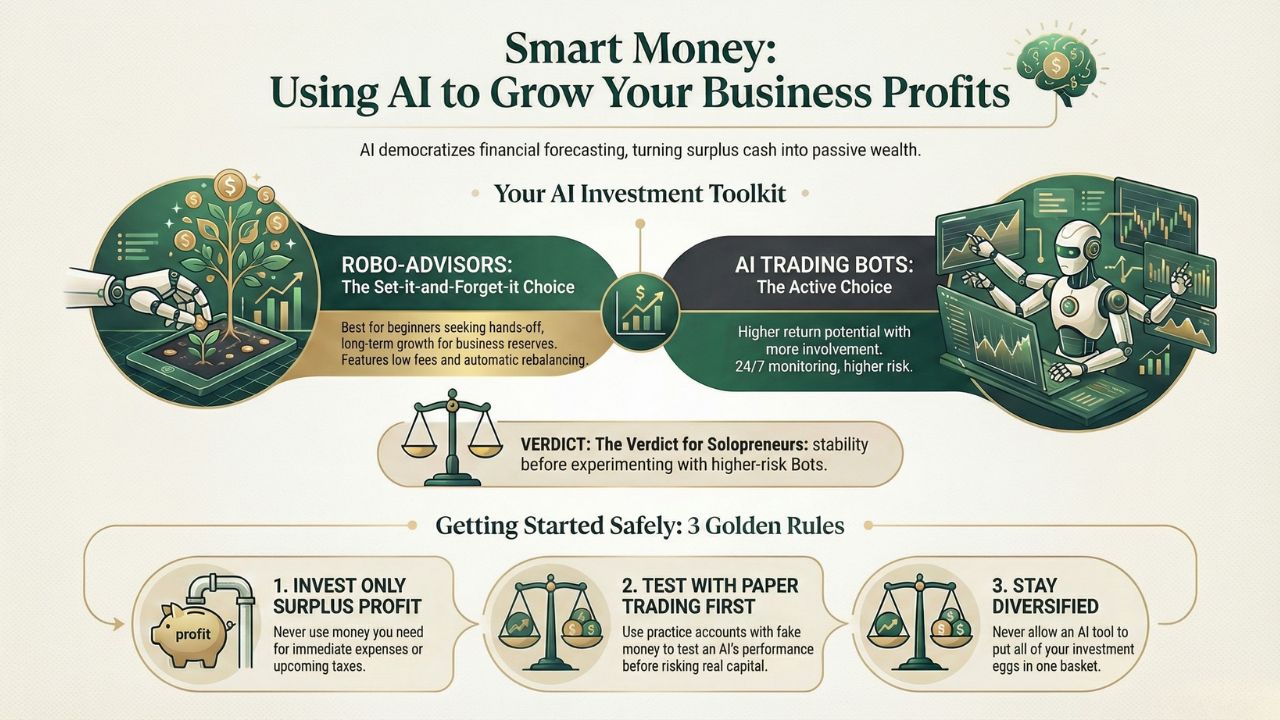

Robo-Advisors vs. AI Trading Bots

When you look for stock market analysis software reviews, you will see two main categories. It is critical to know the difference.

1. Robo-Advisors (The "Set-it-and-Forget-it" Choice)

These are best for beginners. You answer a few questions about your risk tolerance, and the AI builds a diversified portfolio for you.

- Pros: Low fees, hands-off, rebalances automatically.

- Best for: Long-term growth of your business reserves.

2. AI Trading Bots (The Active Choice)

These are AI stock trading software for beginners who want to be more involved. These bots can execute trades on your behalf based on specific triggers (like a stock dropping 5%).

- Pros: Potential for higher returns, 24/7 monitoring.

- Cons: Higher risk.

The Verdict: When comparing robo advisors vs AI trading bots, solopreneurs should start with Robo-Advisors for stability before experimenting with bots.

Predictive Analytics: Seeing the Future?

You don't need a crystal ball; you need data. The best predictive analytics tools for finance use historical data to forecast future cash flow trends. For a solopreneur, this is vital.

- Scenario: Your AI tools predict a revenue dip in August.

- Action: You adjust your ad spend in July to compensate.

This isn't just about stocks; it's about using financial forecasting software for small business to ensure your business never runs out of cash.

Getting Started Safely

If you are ready to dip your toes into AI investing, follow these rules:

- Don't Gamble Your Tax Money: Only invest surplus profit, money you don't need for immediate expenses or taxes.

- Start Small: Test AI stock trading software for beginners with a "paper trading" account (using fake money) to see how the AI performs before risking real capital.

- Stay Diversified: Never let an AI put all your eggs in one basket.

Frequently Asked Questions (FAQs)

Yes. While AI can analyze data faster than humans, the market is unpredictable. Never invest money you cannot afford to lose.

Absolutely. Many automated cash flow management tools are designed specifically to help small businesses earn yield on their idle cash while keeping it accessible for expenses.

No. The modern wave of artificial intelligence investment algorithms is designed for non-technical users. You interact with dashboards, not code.

Sources and References

Reports & Compliance:

- Google Cloud AI Trends Report (2025) - Data on enterprise AI adoption.

- Federal Trade Commission (FTC) Cybersecurity Guide for Small Business - Compliance standards.

Tools & Verification: