Best Business Credit Cards for AI Startups: Fund Your SaaS Stack

"Cash flow is king".

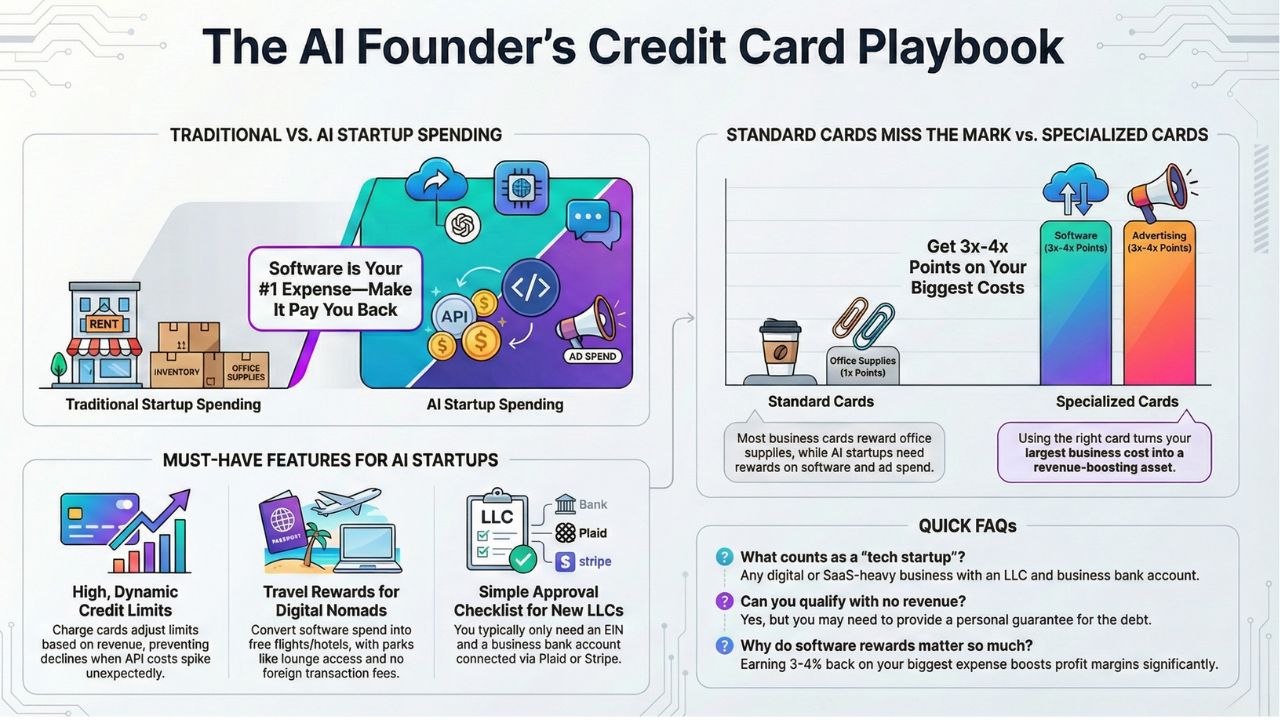

For the traditional business owner, cash flow means buying inventory or paying rent. But for you, the AI Solopreneur, it means something different. Your "inventory" is API credits, and your "rent" is your monthly SaaS subscriptions. If you are running a "Zero-Employee Enterprise," your biggest expense isn't payroll, it's software.

Yet, many founders use personal cards that offer zero benefits for their business spend. This page highlights the best business credit cards tailored for tech-heavy solopreneurs. We’ll look at how to get high limits, earn rewards on your AI tools, and travel for free.

Explore the AI Solopreneur Hub

- The AI Solopreneur: Guide to One-Person Enterprise

- Top 10 AI Agents That Replace Marketing Agencies in 2026

- Best AI CRM Tools for Solopreneurs: Salesforce vs. HubSpot AI

- AI Chatbots vs. Virtual Assistants: The Support Battle

- AI Bookkeeping: Automate Your Business Taxes

- Using Predictive AI for Stock Market Analysis

- Cybersecurity for Solopreneurs: Protecting Data from Deepfakes

- Cloud Hosting for AI: GPU vs. CPU Servers

- Do You Need Business Insurance for an AI Agency?

- How to Build a $10k/Month Business with $0 Upfront Cost

- Case Study: I Let AI Run My Dropshipping Store for 30 Days

- The Death of 9-5: Agentic AI & The Solopreneur Boom

Why AI Startups Need Different Cards?

Regular business cards offer cash back on office supplies or gas stations. That doesn't help you. You need corporate credit cards with software subscription rewards. Why? Because as an AI solopreneur, you are likely spending thousands a month on OpenAI API keys, Midjourney subscriptions, and CRM tools. By choosing a card that offers 3x or 4x points on "software and advertising," you effectively get a discount on your entire tech stack.

1. The Need for Speed (And High Limits)

When your AI agent goes viral, your API costs can spike overnight. You cannot afford to have your card declined. You need the highest limit business credit cards for tech startups.

Dynamic Limits

Look for "charge cards" (like Brex or Amex) that adjust your limit based on your bank balance or revenue, rather than a fixed arbitrary number.

No Personal Guarantee

Some modern corporate cards offer startup financing options without equity, meaning they look at your business revenue, not your personal credit score. This is crucial for keeping your personal finances safe.

2. Travel Like a Digital Nomad

The "AI Solopreneur" lifestyle often means working from anywhere. The best travel rewards cards for entrepreneurs allow you to turn your business expenses into free flights and hotels. If you spend $10,000/month on ads and software, you should be earning enough points for a free international trip every year.

Look for cards that offer:

- Lounge access (for when you work from airports).

- No foreign transaction fees (essential for digital nomads).

3. Getting Approved: The Checklist

Are you a new LLC? Don't worry. Business credit card approval requirements have changed in 2025. You often don't need a massive credit history.

- EIN: You will need your Employer Identification Number.

- Revenue Proof: Connect your business bank account (using Plaid or Stripe) to show cash flow.

There are excellent credit cards for new LLC owners designed specifically to help you build business credit from scratch.

4. The Cost of Capital

Before applying, always compare business credit card interest rates.

Pay in Full

Ideally, you should use a charge card that requires payment in full every month. This keeps you debt-free.

0% APR Intro Offers

If you need to buy expensive hardware (like a powerful GPU laptop), look for cards offering 0% APR for the first 12 months.

Frequently Asked Questions (FAQs)

Generally, any business with a digital product or high software spend qualifies. If you have an LLC and a business bank account, you are a business.

Yes, but your options are limited. You may need to provide a "personal guarantee," meaning you are personally responsible for the debt. Secured business cards are also an option.

For an AI business, software is the new "payroll". Earning 3-4% back on your biggest expense line improves your bottom line significantly compared to a standard 1% cashback card.